If this had been an actual emergency, you would have been instructed to buy gold and turn off the television. Seven months of flat markets tested patience, and the August stock market correction tested resolve. A 10 percent equity market correction in a handful of trading days is a serious gut check and a reminder that volatility lives.

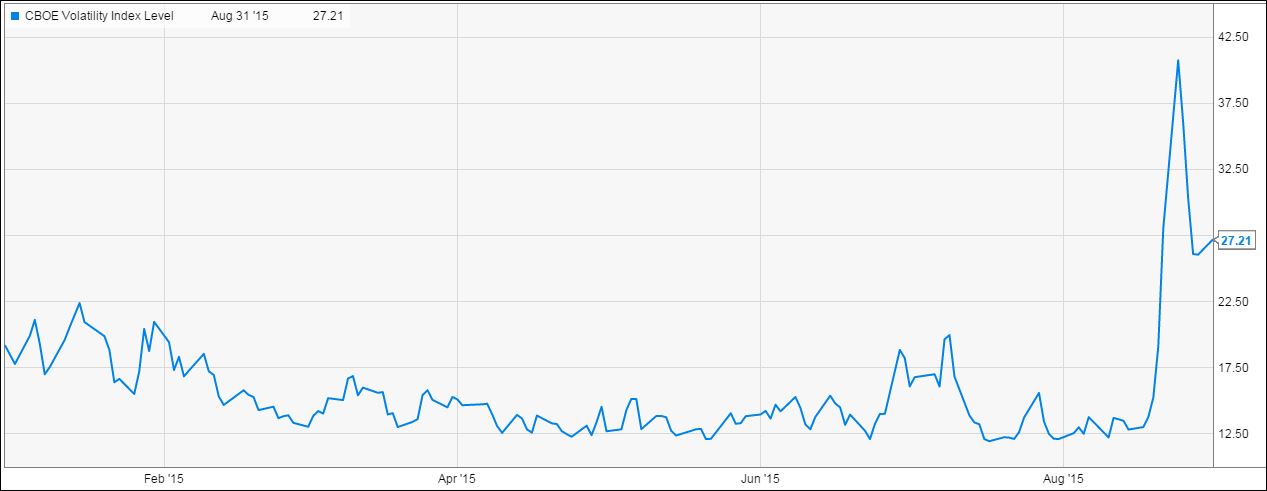

The volatility index (VIX) chart of activity year to date shown below clearly shows the volatility alarm sounding in mid-August.

Portfolios provide valuable feedback on the risk we own. An instant correction, like the August experience, allows us to put personal dollar signs on the market move. It acts as both a financial and an emotional checkpoint. Use this mid-term exam as a chance to ask yourself:

– Do I have a financial plan that considers income, expenses and reasonable growth expectations?

– Do I have too much risk in my portfolio? Too little risk?

– Do I have enough liquidity? Am I positioned to take advantage of market opportunities?

– Emotionally, how did I handle the correction? Was I thinking about buying the sell-off or sprinting to cash?

The U.S. stock market has generated six consecutive years of positive returns, and a record breaking seventh year is questionable at this stage. During August the stock market provided the elusive 10 percent correction from its May peak that everyone was waiting for, so now what? The correction’s origin was rooted in China as slower expected growth from the world’s number two economy sent commodity and stock prices lower. We expect the remainder of 2015 to be a power struggle between the bulls and the bears. The final answer for 2015 is likely to be a flat year. This third quarter correction becomes next year’s opportunity.

We see 2016 having better corporate earnings as a strong dollar and weak oil prices are already reflected in the numbers. We believe the 2016 year-over-year comparisons will be viewed favorably by the global equity markets.

The U.S. bond market provided temporary shelter to an unsettled stock market. Stock volatility sent bond prices higher and interest rates lower. In a typical flight to quality, the 10-year U.S. Treasury yield dipped to a 1.90 percent yield before settling into a month end yield of 2.21 percent, virtually unchanged from the end of July. Meanwhile the 30-year Treasury yield finished up 3 basis points to 2.95 percent.

The Fed Funds rate debate continues, and investors now speculate whether it will be September, December or early 2016 for the first rate hike. Some of the data point to a September hike, but December seems most likely to me given the market jitters. With six years at zero interest rates, what’s a few more months? More interesting will be what the Federal Reserve reveals in its first meeting following the eventual rate hike.

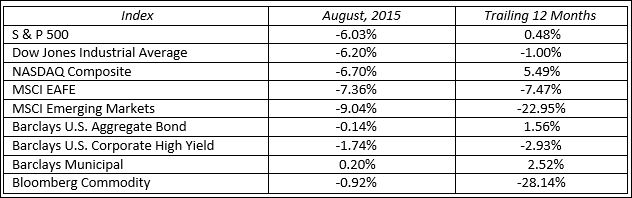

Stock markets had a tough but resilient month as prices recovered somewhat at month-end from larger losses in the third week. The S&P fell 6.03 percent while higher-risk NASDAQ stocks declined 6.70 percent. Utilities was the best performing sector, while Energy was the worst.

The broad Bloomberg Commodity Index provided a bit of relief for the diversified investor. After months of negative returns the index posted a slight 0.92% dip in August as energy prices, a key component, posted sharp gains in the final days of trading.

Volatile markets test investor resolve. It has been smooth sailing for the past few years, and August was a great reminder as to why we diversify portfolios and manage risk. Successful investors have clear goals and objectives, remain focused on their long-term goals and stay resolute during their financial journey. The remainder of 2015 will continue to test investor resolve. This is a healthy exercise and will yield long-term benefits.

MARKETS BY THE NUMBERS: