Last year proved to be a challenging year for all market participants. The markets did not discriminate. Whether you were a top hedge fund manager, Warren Buffet, a seasoned investor or someone new to the game, 2015 frustrated everyone. Usually there is one star asset class separating winners from losers. Not so in 2015. Even 2008 had its star performer when long-term U.S. Government bonds returned 28.8 percent in an otherwise disastrous year.

There were no performance champions last year. While most major asset class avoided huge declines, there was plenty of pain in some of the sub-sectors. Most investors owning a diversified portfolio in 2015 saw their money go nowhere or decline in value. The flat to down returns are not a surprise when you analyze the various asset categories.

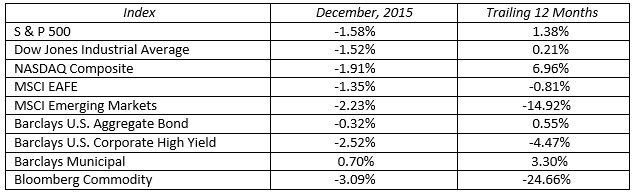

The U.S stock market was basically flat for the year with a wide dispersion of returns among sectors. Consumer discretionary was the best performing S&P 500 sector up 7.3 percent, while energy was down 24.0 percent. International stocks from developed countries were down 0.8 percent and emerging markets were down 14.9 percent for the year. There was a lot of hype and speculation regarding higher interest rates, but very little changed. Short-term Treasuries were up a bit, long-term Treasuries and corporate bonds down a bit, while high yield bonds suffered from the plight of the energy sector. For the doom and gloom gold bugs, they saw their value drop by 11.4 percent and broader commodities fell by 24.7 percent

In the big picture, the markets were due for a lackluster year. It’s been a great six year run and year seven was a blah investment year. The past is the past, and what matters now is where do we go from here?

While it is not wise to expect miracles in 2016, we believe it is fair to expect reasonable returns despite a tough first week. For stocks, mid-single digit returns would qualify as reasonable. U.S. stocks will face lighter headwinds in 2016. Stocks will benefit from continued low global interest rates, an eventual bottoming of oil prices, moderation of dollar strength, resilient consumers, and favorable earnings comparisons in the quarters ahead. Global stock markets still need to contend with slowing economies, differing central bank monetary policies, commodity price direction and heightened geo-political risk. International and emerging market stocks may catch enough of a tailwind from local currency weakness to boost their income statements and relative stock performance.

The bond market waited all year for the much anticipated Federal Reserve rate hike. This year may prove to be an instant replay of last year. Once again, everyone is expecting higher rates and multiple Fed moves. In reality, the Fed will talk a good game but likely leave rates alone creating a stable yield curve. The yield on the ten-year Treasury may stay in the 2.0-2.5 percent range waiting for a meaningful change to the macro environment. Expect bonds to be boring with low single digit returns into the foreseeable future.

In the past few years the importance of long-term diversification has been lost with the consistent superior performance of U.S. equities. Times may be changing. Diversified portfolios are still the vehicle of choice when travelling long distances. Stay your course for the long haul.

MARKETS BY THE NUMBERS: