Gold serves several purposes in a portfolio. For the last four years, there has not been much interest in the metal, but investors have been buying recently.

In fact, the price of gold is up 15% year to date, its best start to a year in 35 years as it outperformed stocks. See chart below* illustrating the performance of Gold (black line) versus the S&P 500 (blue line).

What’s driving the gains after years of under-performance? It’s the various roles that gold serves:

a) risk reducer in a volatile environment

b) protection against inflation

c) retention of purchasing power

d) protection against any possible decline in the U.S. dollar

e) a safe haven from “black swan” events

Let’s take a deeper look into each of these roles.

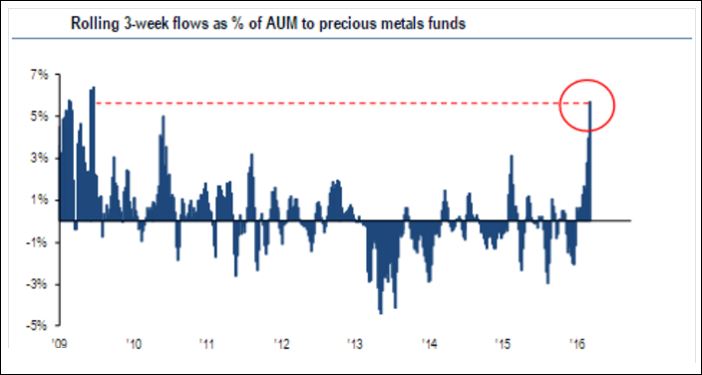

a) Gold is a non-correlated asset class, meaning that it doesn’t move in the same direction as the price of stocks or the price of bonds. The addition of gold can potentially reduce risk in a portfolio. In a volatile environment, as we saw in the Chinese stock market at the beginning of the year, it is actively sought out. We saw this in the sharp rise in money flows to precious metals funds in the first several weeks of this year as shown in the chart below.** Inflows haven’t been this strong since 2009.

b) Gold protects against inflation as it retains purchasing power by rising in value during inflationary times.

c) A handful of countries overseas are actually charging customers to keep their money in a bank these days, a complete reversal of traditional interest payments to depositors. Fear that this new practice will occur in the US as well is partly responsible for the recent gains in gold prices.

d) Gold protects against declines in local currencies. In fact, it often moves in the opposite direction of the US dollar. The US dollar has strengthened over the last two years versus most of the world’s currencies. If this reverses, we believe investors would benefit with a position in gold.

e) In the event of global upheaval, be it caused by terrorist attacks, war or any other unexpected geopolitical or financial shock, gold can be relied upon as a store of value. During these “black swan events”, gold prices rise as the metal becomes a go-to currency.

Currently gold is still less than 1% of global investors’ portfolios. It continues to be under-owned despite the recent price appreciation. With limited supply, this leaves the potential for further price appreciation. You could buy gold bars, metal coins, stocks or mutual funds holding gold miners. Exchange traded funds (ETFs) provide flexibility since they are priced daily, are highly liquid and track the price of gold accurately.

At Nevada Retirement Planners, we currently include a gold ETF in our Endowment Series. Gradient’s Precious Metals portfolio is our most direct method to benefit from higher precious metals prices. The portfolio includes positions in gold along with silver, platinum and palladium. In addition, precious metal mining company stocks are included.

In summary, precious metal investing can be volatile, but a reasonable allocation to this asset class over time can be beneficial.

To expand on these Market Reflections or discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222

Sources:

* Yahoo Finance interactive charts ** Bank of America Merrill Lynch, EPFR Global