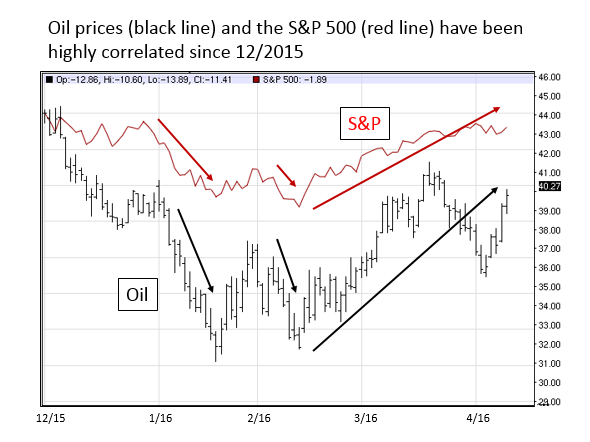

The stock market has rallied off the lows of January/February to stand slightly positive for the year. Part of the story has been the decline and subsequent recovery in oil prices during the first quarter. Oil prices and stock prices seem to be tied at the hip recently as illustrated in the chart below:

Oil prices seem to lead this correlation (oil up/market up and oil down/market down). Investors have been concerned that low oil prices would:

- Hurt overall earnings growth of the S&P 500

- Damage the high yield market if defaults rose in the energy sector

- Slow the global economy as energy production declined

These concerns appear to be valid. As oil prices have declined since mid-2014, the market has stalled since late-2014. Oils decline has been caused by an oversupply situation across the world. Oil crashed from more than $100 a barrel to a low of $27. Sentiment was especially grim earlier this year, but recently this has changed. Investors are beginning to sense the supply/demand imbalance is beginning to correct itself and oil prices (along with the market) have rallied.

Is oil demand increasing and supply actually falling? Let’s look at some recent data points to see.

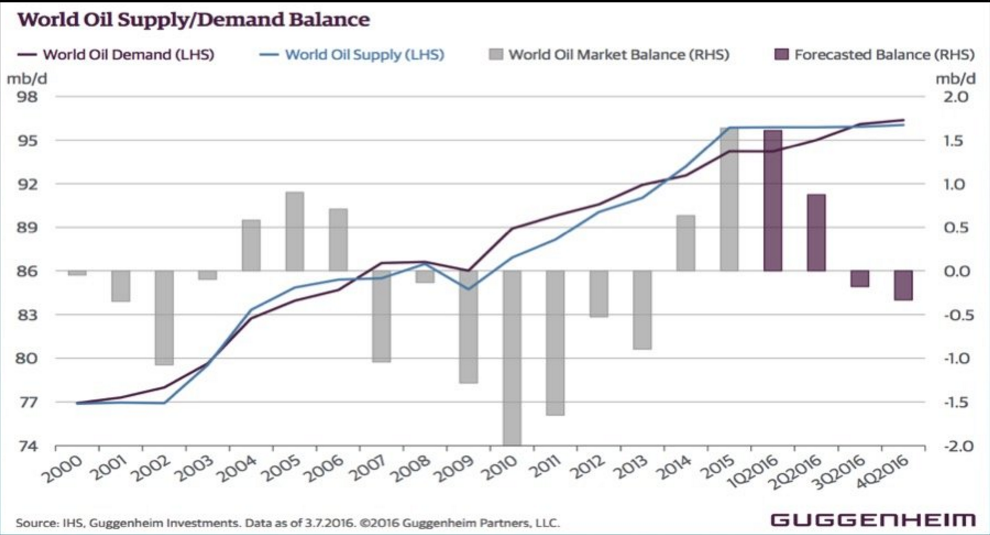

On the demand side of the equation a consensus of energy analysts seems to feel that global demand will continue to grow. The IEA (International Energy Agency) expects higher demand in 2016 versus 2015. Researchers at Bernstein expect global oil demand to increase at a mean annual rate of 1.4% between 2016 and 2020, compared with annual growth of 1.1% over the past decade. They also “expect oil markets to rebalance by the end of 2016”. Bernstein adds that it forecasts global demand to reach 101.1 million bpd by 2020, from the current 94.6 million bpd.

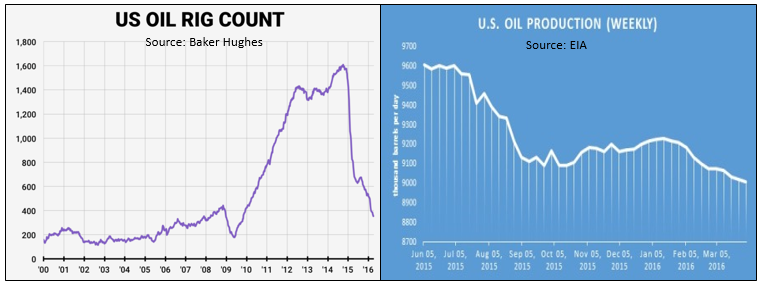

More importantly, growth on the supply side of the equation seems to be abating, especially in the US. In reaction to substantially lower prices, domestic exploratory oil rigs have been taken off line, and production is falling. See the charts below:

In short, as rig counts (exploration) fall, production eventually falls. This process takes time, but eventually is positive for prices.

Finally, Guggenheim feels that global demand (purple line) will outstrip global supply later this year as non-OPEC production falls and world supply (blue line) flat lines. See the chart below illustrating this inflection point:

In conclusion, oil markets became over-supplied, but are self-adjusting through higher demand and lower supply. The adjustment process takes time, will be volatile, but is absolutely happening. If oil prices continue to recover over the next year, this should be a tailwind for the equity and high yield markets. The Gradient Energy Sector Portfolio was up close to 10% in the first quarter as its positions benefited from the recovery in oil prices. Further gains would be expected if oil finishes closer to $50 per barrel as we exit 2016, and $60 as we exit 2017.

To expand on these Market Reflections or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222