Its mid-June already and time for a semiannual assessment of the markets. As of June 14th both the stock and bond markets are positive in the U.S.

· The S&P 500 is up 2.60%

· The Barclays US Aggregate Bond Index is up 4.52%

Looking back to the beginning of 2016 the Gradient Investment team forecast US stocks would grind higher by mid-single digits (about 5%) and the bond market would also grind out a 1-3% return as interest rates stay low. The stock market looks to be tracking our forecast (albeit with an increased level of volatility) while bonds have been surprisingly strong as rates have actually moved lower this year.

Below are 3 things that encourage us about the markets:

1. The US economy continues to expand at a moderate pace. GDP is pacing at a 2% year over year growth rate, the labor market has strengthened and the consumer is fairly healthy. See the chart below highlighting US economic growth expanding at a healthy rate:

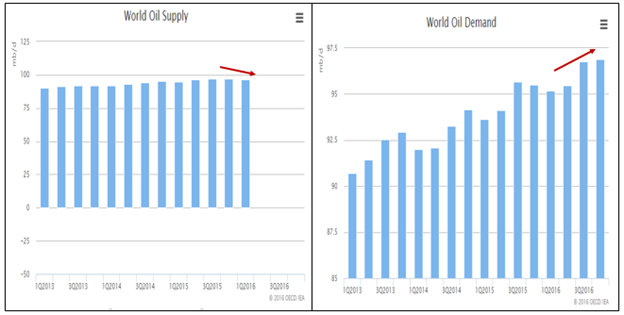

2. Oil prices have recovered in 2016 and now sit close to the $50 per barrel level, up from its bottom in the mid $20’s. This is extremely positive for the energy related sectors of the S&P 500 and the high yield bond markets. Low oil prices around the globe have forced capacity to come offline. At the same time, demand for oil is starting to increase. This is a positive equation for future stability in oil prices. See the chart below illustrating world supply and demand for oil:

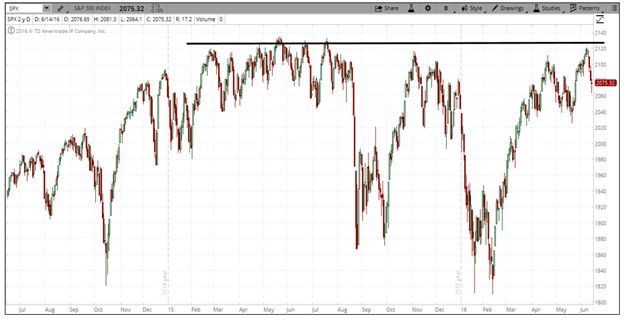

3. Stock prices have recovered and gone positive for the year after a rocky start to the beginning of the year. In both January and February investor conviction was tested during market corrections that at one point exceeded a price retraction greater than 10%. The recovery shows that investors are still willing to buy the dips, and demonstrates collective confidence in the markets.

Below are 3 things that discourage us about the markets:

1. International markets continue to show anemic growth (Europe) or slowing growth (China and other emerging markets). The blue chip US companies we invest in derive a big portion of their revenues from overseas and demand from their economies is currently not that strong.

2. Stock prices have recovered from the corrections in late 2014 and early 2015, but have failed to break out to new highs. Technically a breakout to new highs is a positive and a failure is negative. Trust me, there are a lot of portfolio managers who look at charts. See the chart below highlighting the failure of stocks to reach new highs (black line):

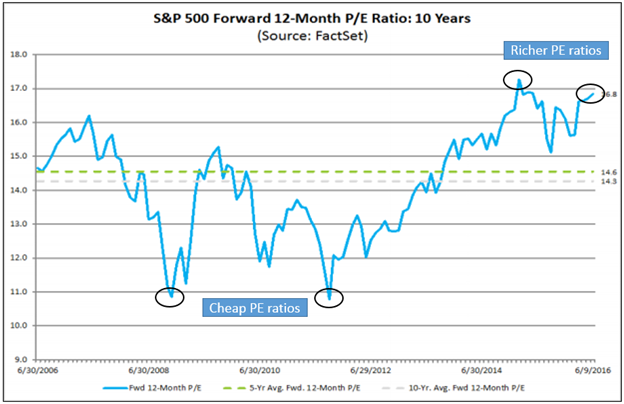

3. Earnings growth is still disappointing as both first and second quarter S&P 500 earnings are down on a year over year basis. On top of this, valuation levels are above long term averages. A lack of earnings growth with extended valuations are an adverse situation for stock prices. The chart below shows the current PE (price to earnings ratio) for the S&P 500:

Below are 2 things I don’t worry about:

1. The upcoming US presidential elections in November. Regardless of who wins, I still believe that politicians tend to inherent the market/economic cycles versus influence them.

2. The Federal Reserve’s interest rate policy. The Fed will raise/normalize interest rates at a very measured pace, and they will only raise them when economic data is strong enough to mandate a Fed Funds increase. I’m not concerned when extremely low rates rise due to a strong economy. When the 10 Year US Treasury rate moves closer to the 5% level it becomes worrisome. We’re currently at 1.61% (a long way away).

Where do we go from here?

The bond market has done well, and we expect that most of this year’s price gains may have already occurred. Remember, bond coupons will continue to be paid over the remainder of the year.

We continue to forecast mid-single digit stock market returns for 2016. We think the economy will continue to expand, but the key is the return of earnings growth to corporate America. After a nice run from the lows in February, we could see a slight pullback in stock prices, but we DO NOT see a major correction in the market. Several GI portfolios (G50, Gradient Tactical Rotation and Absolute Yield) have soundly beat the market thus far in 2016! For those clients whose portfolios reflect their targeted risk tolerance, stay the course. For those clients considering less risk exposure in their portfolios now may be a time to make some minor adjustments.

To expand on these Market Reflections or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222