January brings a New Year with new political leadership and a new set of economic and political uncertainties. This is both normal and healthy. Learn to embrace change and volatility as it often creates long-term investment opportunities. Since we do not have a crystal ball, we evaluate the road ahead by actively monitoring key fundamental factors. Let’s walk the road as we see it unfolding this year.

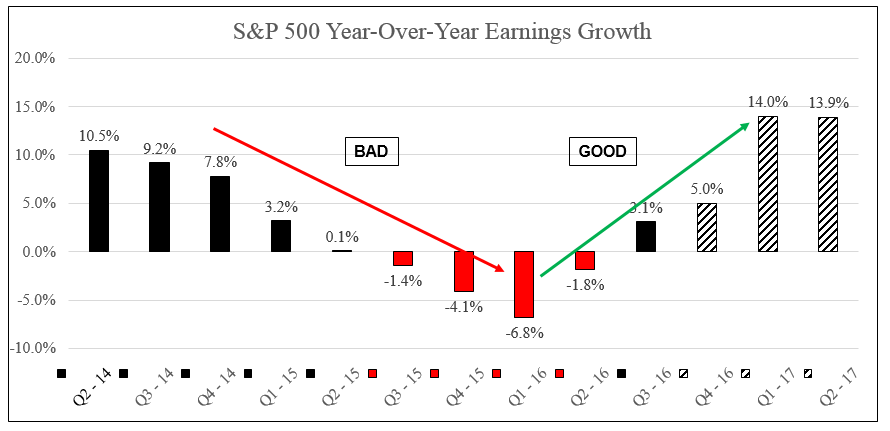

Yes, the stock market continues to trade near all-time highs and a temporary early year price consolidation would not be a surprise. Equally possible is the scenario where the train continues to pull away from the station as new pro-growth policies and potentially lower corporate taxes benefit stock prices. The fundamental facts as we see them show stable to expanding core economic growth through 2018. Future growth in the 2-3% range will push the stock market higher. At the heart of the fundamental story is an acceleration of corporate earnings. The stock market navigated the deceleration of earnings growth and now we enter a more positive earnings phase. Remember, its earnings and valuation that drive stock prices. Positive earnings will be a positive force.

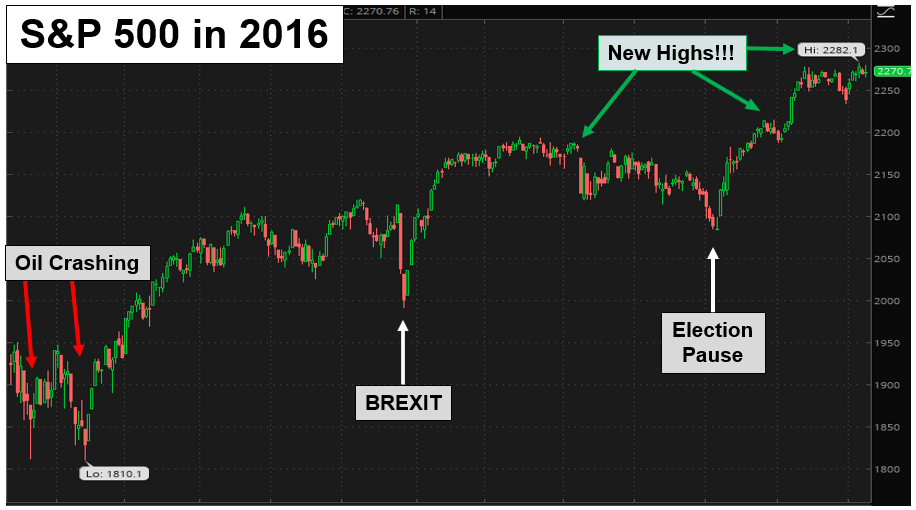

We see the U.S. stock market generating positive returns in the 5-10% range for the calendar year. Experience tells us the path to high single digit returns is not a gentle sloping line, rather a series of rallies and subsequent pullbacks. This year may in fact look like last year’s price action with new reasons for periods of price consolidations. Below is the 2016 path traveled.

If stocks are up 5-10%, what happens to bonds? The bond market is entering a new phase as the Federal Reserve’s seven year zero interest rate policy is coming to a close. Interest rates will begin an orderly move higher lead by the short end of the yield curve. The Federal Reserve now has room to begin the process of normalizing monetary policy. While the Fed has threatened for two years to embark on a systematic plan to hike the fed funds rate, we believe this is the year where it really begins. Three or four quarter point rate hikes will leave the fed funds rate near 1.50% by the end of the year.

The journey to higher interest rates will cause bond prices to decline and returns to be skimpy in 2017. Flat is our call, but plus or minus a few percentage points can easily occur. Investors should still own bonds for reasons of principal preservation, income generation or for overall portfolio volatility control, but realize this is not an asset class to make you rich this year. After higher interest rates are achieved, bonds will offer a more compelling future value. Bottom line in 2017 is, “don’t expect much offense from your bond portfolio”.

Every time period deals with market volatility and uncertainty. The markets have survived two World Wars, the great depression, stagflation, an oil crisis, the internet bubble and a financial crisis. This time is no different as the weight of the world can cause rational investors to second guess their investment decisions. This a dangerous trap to fall into, so be strong and avoid the temptation to eliminate risk. Risk makes you wealthy. Traveling through your investment horizon with confidence, conviction and patience is hard work, but the rewards are great. Five years from now, it will not matter if the market is up or down 5% in the next few months. Stay long and strong for the long haul.

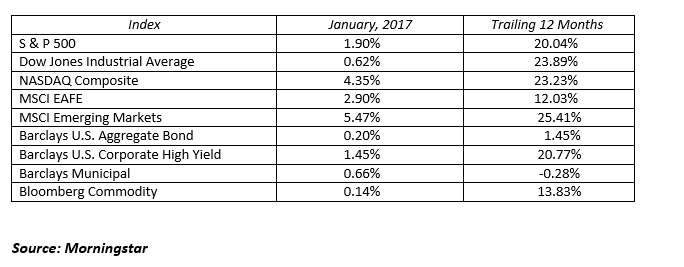

MARKETS BY THE NUMBERS:

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222