The market has been on an impressive run recently. To review, as we neared the election, the S&P 500 had slid roughly 5% from recent highs and closed at 2,083 on November 4th. Since that time, the S&P 500 has returned 14.8% to close at 2,378 on Friday, March 17th. In today’s Market Reflection, we are going to analyze what has worked, and what hasn’t worked, during this period.

Sectors:

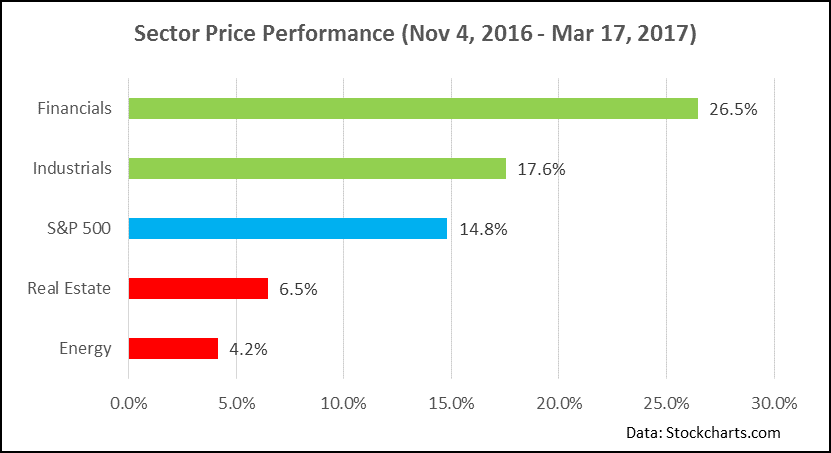

During this recent market rally, there has been a wide divergence of sector performance within the S&P 500. Financials and Industrials sectors have been leaders while Energy and Real Estate have lagged (see below chart). Financials performance has been tied to two factors: rising interest rates which tend to benefit banking and insurance companies, and sentiment that regulatory costs may be less of a burden with the newly elected administration. Industrials performance has been a result of improving fundamental and economic data combined with positive sentiment regarding potential enhanced infrastructure spending to accelerate GDP growth.

Sectors that have lagged the market include Energy and Real Estate. Energy performance has been hampered by a retracement of oil back below $50 amidst discussions of increased supply returning to the market. Real Estate underperformance can be explained by valuation in a rising rate environment. In a low yield environment, where investors are seeking income, Real Estate Investment Trusts (REITs) tend to receive a premium valuation due to their relatively high dividend payments. When interest rates begin to rise, REIT valuations tend to drop as investors transition to lower risk assets to generate their needed income.

Style:

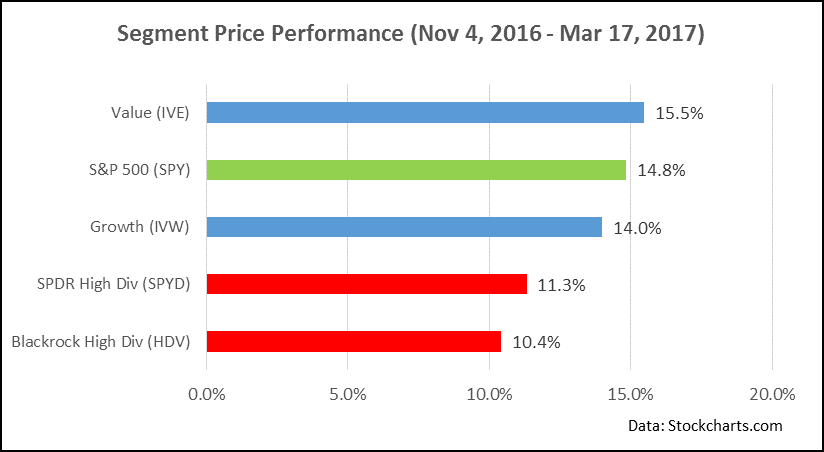

The below chart reflects S&P 500 performance by style. As you can see, there hasn’t been a dramatic divergence of performance within the classic style segments of value and growth. Where we have seen a large style differential is the underperformance of high dividend paying stocks. According to the chart below, two large cap, high dividend ETFs (HDV and SPYD) have underperformed the overall market since the election. The issue for high dividend stocks is similar to the situation for REITs described above. As investors generate more income from bonds (through higher interest rates), there is less willingness to pay a premium for dividends generated through the stock market. This transition typically affects Real Estate, Telecommunications, Consumer Staples and Utility sectors the most. Most high dividend portfolios tend to have greater concentrations in these sectors compared to the overall market. Therefore, in a rising rate environment and an expectation of accelerated growth, it is fairly common for dividend focused portfolios to underperform the general market.

In conclusion, though we have seen very strong performance post-election, it is important to realize that this is a very short period of time for which to make broad conclusions. Sectors and styles are continually adjusting in and out of favor, and it takes a disciplined investment process to stay focused and avoid “chasing” short term trends that may erode long term performance.

At Nevada Retirement Planners, we design portfolios with long term objectives in mind using strategies that have been proven over several investment cycles. Each portfolio is designed with a core philosophy that is designed to meet a variety of client needs like principal preservation, income generation, or growth. Lastly, we use multi-portfolio solutions to generate diversified sources of return that meet client needs and are consistent with their risk tolerance and time horizon. If you would like to learn more, please give us at call at 775-674-2222.