As the stock markets reach new all-time highs, publicly traded companies are just beginning to report sales and earnings for the second quarter of 2017. Over the next couple of weeks we will be watching for a number of data points within the earnings reports, along with management commentary around their businesses.

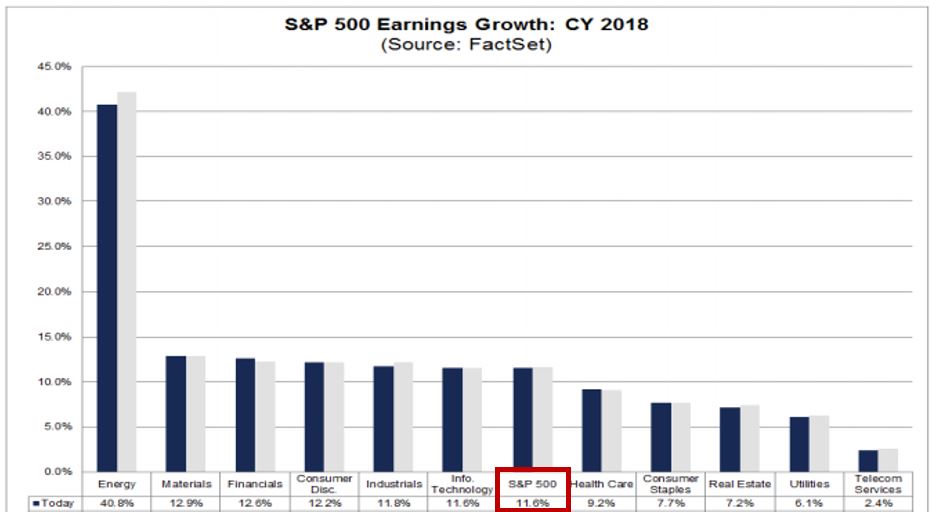

We have been seeing year-over-year earnings growth accelerate over the past several quarters for the broad market index, the S&P 500. In fact, S&P earnings were in decline for four quarters (mid 2015 to mid-2016), with the drop attributed to just one sector, energy. For the first quarter of 2017, we saw earnings growth of 14%; we expect 10% growth in the second quarter. We currently expect earnings growth to accelerate in the second half of this year, providing a strong foundation for the stock market. Looking further out, consensus earnings growth of nearly 12% is expected for 2018, according to FactSet, as seen in the chart below:

A company’s earnings growth is not the only driver of a stock’s price, however. In fact, a study by McKinsey & Co. showed that a 1% beat had virtually no impact of the price of a company stock five days after the earnings announcement.* Often, companies will guide analysts’ expectations down prior to the quarterly report in an effort to create a beat…managing expectations, some might say. More important, we believe, is the quality of earnings and management’s outlook versus current expectations.

We look for sales and earnings growth from core operations, not boosted by one-time events or shifts from one quarter to the next. We want to see expanding operating margins, not an earnings benefit from a one-time item such as a lower tax rate. Investors should be encouraged by management’s discussion of rising orders or new technology that will grow the business over the longer term. Is the sector showing greater growth characteristics than most have expected? Management sentiment around improved operating efficiencies or a more suitable capital structure are other positive factors that can drive stock prices higher.

Yes, a series of disappointments will impact the price of a stock over time. The disappointments would create distrust in management’s ability to accomplish their goals. Similarly a pattern of significantly exceeding expectations will lead to stock price outperformance.

However, a single disappointment, if accompanied by an improved short and/or long term outlook can result in positive stock price performance. We believe we are in a period of rising earnings, which tends to be positive for stock prices. Stay tuned.

* McKinsey & Co. Strategy & Corporate Finance – 2013

To expand on these Market Reflections or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222.