When investors select assets for their portfolios, it is important to be aware of risk. The risks of a portfolio should be known and should be aligned with your return needs, time horizon, and risk tolerance. While risk is normally associated with price risk, or how much an asset can go up or down (most investors are concerned with downside risk), there are other “hidden” risks that should be considered.

Hidden volatility

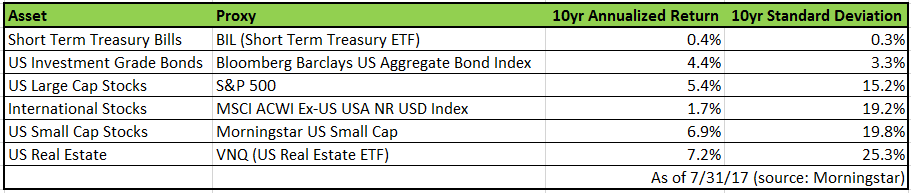

An asset’s risk generally corresponds to the type of investment. For example:

- Bonds backed by the US Treasury are considered lower risk while stocks, which have a high degree of uncertainty regarding the future, and are considered higher risk.

- Volatility, as measured by standard deviation of returns, tends to follow this pattern as well. Bonds tend to have lower standard deviation while assets like stocks have higher standard deviation (seen in the chart below).

In certain situations, however, price volatility may not accurately reflect the risk being taken. The primary examples of this would be privately traded securities, like private real estate or private equity. These assets are not typically traded nor priced on a daily basis, and as a result, standard deviations may show less volatility than their public counterparts. While standard deviation may indeed be lower, this does not mean that these investments should be treated as lower risk assets! Because privately traded assets are similar investments to public REITs or publicly traded stocks, they should be considered as at least comparable risk, if not higher risk, than their public counterparts. The reason for treating these as potentially higher risk investments is their lack of liquidity. Several private investments have redemption restrictions, which means you may not be able to sell out of the asset completely if you so desire.

This does not mean that these investments are worse than their public counterparts. For a subset of investors, private investments may make a lot of sense. However, it is important that investors understand what they own and the risk involved in owning that asset. Simply because an asset doesn’t fluctuate doesn’t mean there is no risk. Daily pricing fluctuations can be considered the cost of owning a liquid investment. Despite this, however, liquidity tends to reduce risk as it allows for entry or exit as needed.

The risk of being too conservative

When investors think of risk, they typically think of how much of their assets they can lose in an investment. Another risk that doesn’t get enough attention is, am I taking enough risk to meet my return needs? This is especially critical for investors that are saving for retirement as they accumulate assets, but is also critical for those nearing or at retirement as well. For those at the retirement stage, it is important to ensure that the portfolio they have accumulated is sufficient to replace the income needed that will no longer be coming from working.

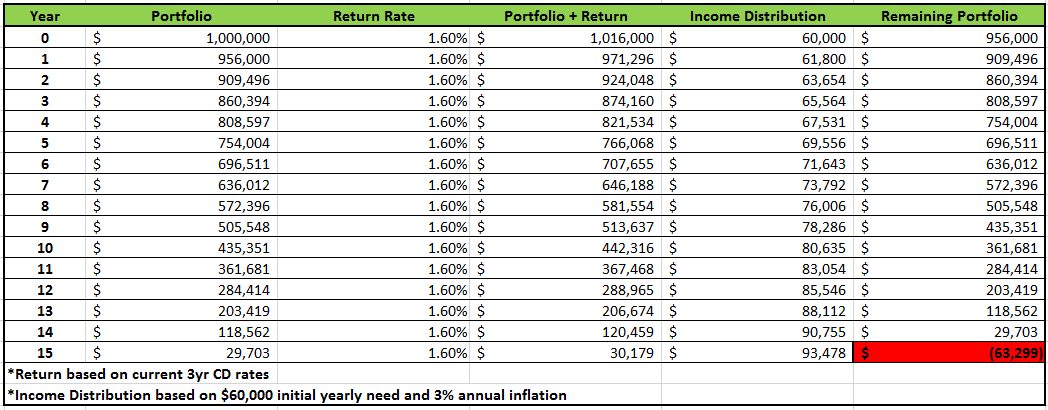

As an illustration, the average age of retirement is 63 while average life expectancy for a US citizen is 79 years old (based on US census data). That means, on average, retirees need to plan for 16 years of income as they live through retirement (and most should plan for more to ensure they don’t outlive their assets). Investors need to ensure that portfolios are sufficient not only to satisfy their near term spending needs, but also achieve enough return to offset the effects of inflation and any life changes that may occur. An example displaying the risk of being too conservative is displayed in the data below, which shows:

- $1,000,000 portfolio invested conservatively in 3yr CDs (assumed rate: 1.6%).

- The annual distribution is $60,000 per year and growing at a 3% inflation rate.

Based upon this scenario, this portfolio runs out of assets by year 15, one year short of the average retirement length! The risk of being too conservative really is the risk of running out of assets in future years, when your ability to replace those assets is limited.

How to protect yourself

1. Know what you own: It is important to understand what you are invested in, what it is meant to do, and the risks involved. Our portfolios provide this through transparency on our investments, clarity on their use, and where they fit within client return needs and risk tolerance

2. Have a plan: The best protection against risk is to have a strategic plan that details the objective, return needs to achieve the objective, takes risks into consideration, and is flexible to adapt to changing circumstances. Investors with a strategic plan can feel more confident in taking prudent risks as they are aware of their circumstances, understand the design of the plan, and are active in communication of any life changes that may require a plan adjustment.

To expand on these Market Reflections or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222.