Fundamentals drive market prices over the long-term. Things like corporate earnings, consumer confidence, employment, inflation, valuations, and economic growth matter greatly to the financial markets. There are times when political and geopolitical events can temporarily hijack markets. As the noise intensifies over Washington’s political agendas and national divisions, the market becomes more vulnerable to temporary price movements.

We experienced a spike in volatility in August and this scenario could repeat itself in the months ahead. Much of the so called, “Trump Rally” was based on expected pro-business reforms of lower taxes, better healthcare, fair trade and decreased regulations. The market loved the original message and is now in the process of distinguishing between hope and reality. While the media will do its best to sensationalize the struggles in Washington, the markets will ultimately respond to actual economic fundamentals.

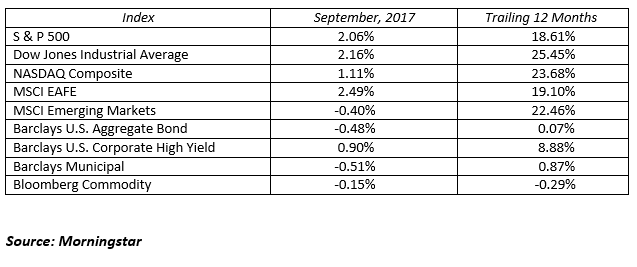

Despite the uproar in Washington and tough talk on North Korea, the stock and bond markets took all the noise in stride producing flat to slightly positive results. Both emerging market stocks and the NASDAQ Composite were the best performing major indices this month posting 2.23% and 1.43% respective returns. Over the trailing 12-month period both had returns just north of 24%. The range of monthly returns was very tight as the worst performing indices (Barclays U.S. High Yield Bonds and international stocks represented by MSCI EAFE) both showed a minuscule decline of 0.04% in August.

In the U.S. stock market, winners and losers were determined either by industry or individual company results. The industry laggards were energy (again), healthcare and retail. Utilities, a long-time safe haven, had a good month supported by low interest rates and increased market volatility. Some second quarter earning disappointments severely punished some companies, while others had excellent results and were rewarded. Footlocker, Nike, Lowes, and Dicks Sporting Goods represented some of the retail carnage. On the flip side, companies like Norwegian Cruise Line, Blue Buffalo, Air Lease and Alibaba reported better than expected numbers and all reached new 52-week high share prices in August.

In the bond markets, interest rates stay low and credit spreads remain tight. This trend will continue into the foreseeable future. Economic growth would need to heat up into the 3-4% range to move interest rates higher. A major geopolitical event and or a serious stock market correction would be needed to jolt credit spreads wider. The current combination of low inflation, slow economic growth, and stable prices has the bond market in a very stable place.

Markets influenced by political events typically become buying opportunities. If the Washington rhetoric heats up and the fundamentals continue strong, averaging into a down stock market may offer a compelling proposition. If you are already invested at a risk appropriate level, avoid selling weakness and maintain the commitment to your long-term portfolio. Despite all the noise; people have jobs, the consumer is confident and willing to spend, and corporations are growing. This is a perfect foundation for success.

MARKETS BY THE NUMBERS:

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222