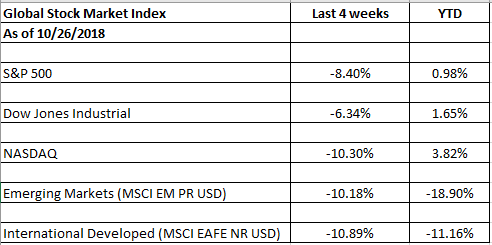

Global markets have been under pressure so far in October. In fact, there really hasn’t been any safe-haven around the world except cash. Let’s look at the returns of the last 4 weeks and year-to-date (YTD) as of 10/26/2018 in various markets around the world*:

Those type of returns around the globe are alarming. Especially when things seem to be doing well in the US economy and corporate America. Isn’t US GDP growth quite strong, unemployment at record lows and corporate earnings growth strong? They are, so what is causing investors so much anxiety these days? I’ve explored several reasons why investors might be selling below:

The Federal Reserve has been raising interest rates. So far in 2018 there have been 3 rate hikes with the Fed telegraphing one more in December. Concerns abound that the Fed will raise rates too fast and spur on an economic recession. The benchmark 10-year treasury is now over 3%, a level it hasn’t seen since December of 2013. See chart below**:

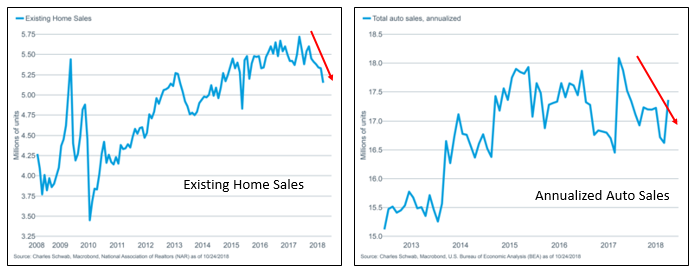

In reaction to higher rates, homebuilding and auto industries are showing some slowdowns. These are important industries in the US. Will this continue? See charts below:

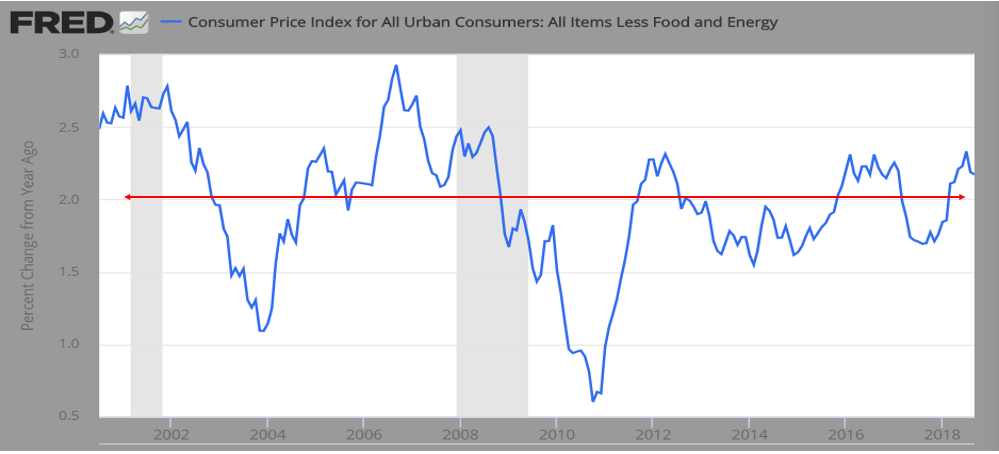

Inflation also has investors concerned. Full employment can lead to wages growing and a strong economy can lead to higher costs both for consumers and corporations. Inflation is now above the 2% level which is the Fed’s longer-term target. See chart below**:

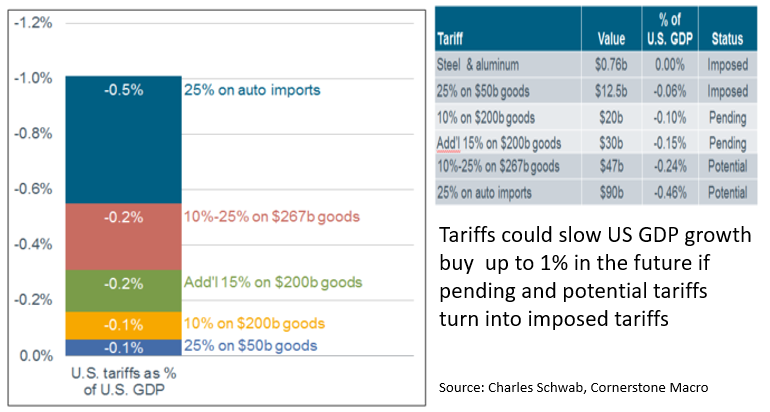

The tariff wars the US is having with other countries is also causing investor angst. So far, the tariffs that have been imposed have not slowed down the economy. But if the trade war continues there is the potential for it to negatively impact the economy. The below chart reflects the possible negative impact a tariff war could produce on our economy’s GDP growth:

Finally, there seems to be some concern that the US economy and corporate earnings growth has peaked and will incrementally look less robust in 2019. There is some merit to this as earnings growth in 2019 is forecast around 10% yr/yr (versus roughly 20.5% in 2018)*** and it will be hard for the US economy to continuously produce 3-4% GDP growth every year.

In summary, investors are concerned about rising interest rates, inflation, tariffs and a peaking US economy. In addition, we are now in 3rd quarter corporate earnings reporting season and many CEOs are mentioning that inflation and tariffs have the potential to hurt their profits going forward. All of this has led to the market pulling back despite what seems to be a constructive environment for stocks.

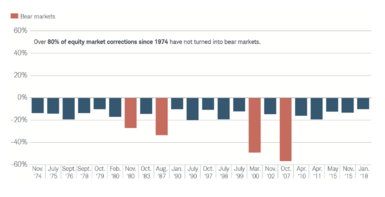

Is this just another correction in the stock market that happens all the time? Or is this the end of the long bull market and the start of a bear market? We don’t have a crystal ball, but we feel this is an overdue correction and not a crash. We don’t see the economy slipping into a recession anytime soon. Remember corrections (periods of 10-20% declines) are much more frequent than bear markets. In fact, since 1974 of the 22 corrections that have taken place only 4 have turned into bear markets. See the chart below****:

Stock markets look forward, and right now the concern is about future growth being negatively affected by interest rates, tariffs, inflation, etc. In times like these it helps to keep an eye on the longer-term and ask yourself if you are correctly allocated between stocks and bonds. Also, look back and see if your financial goals and objectives are on track. If they are, stay the course. Don’t let the emotional halo of a correction drive you into decisions you may regret.

*Morningstar, Inc Index Performance: Return (%)

**Economic Research, Federal Reserve Bank of St. Louis

***FactSet, Earnings Insight, October 26th, 2018

****Schwab Center for Financial Research with data provided by Morningstar, Inc. The market is represented by the S&P 500 index.

To expand on these Market Reflections or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222.