On the heels of a terrible month in the stock market, the market righted itself keeping the wounded bull alive. The fourth quarter’s swift and painful stock correction proved an opportunity to buy stocks at clearance prices. The New Year brought renewed hope as interest rates remained stable and stock prices began to rise from some oversold conditions.

The main catalysts for this much needed turnaround were:

- A change of perspective at the Federal Reserve Bank. The comments coming from the Fed throughout the fourth quarter were very hawkish. They were clearly on a mission to raise the fed funds rate with regularity and had the balance sheet reduction program (a.k.a. Quantitative Tightening QT) on auto pilot. After the December rout, they lightened their language to a more dovish stance emphasizing patience and data monitoring. The market breathed a sigh of relief.

- Corporate earnings season began. The early read here has produced mixed results, but overall expectations are for 5-10% earnings growth this year. This is good news for stock prices, especially in light of the lower valuations coming out of year end.

- A glimmer of hope on China trade. The U.S. and China are having high level in-depth meetings leaving investors with the belief some trade resolution is possible. This is a complex multifaceted issue that will take years to completely resolve, but there are signs tariff escalations can be halted and some preliminary agreements reached.

- The government is back in business (for now). The partial government shutdown was more of a political event and less of an economic event, but it does remove a barrier for now and possibly will lead to new headlines about things that matter.

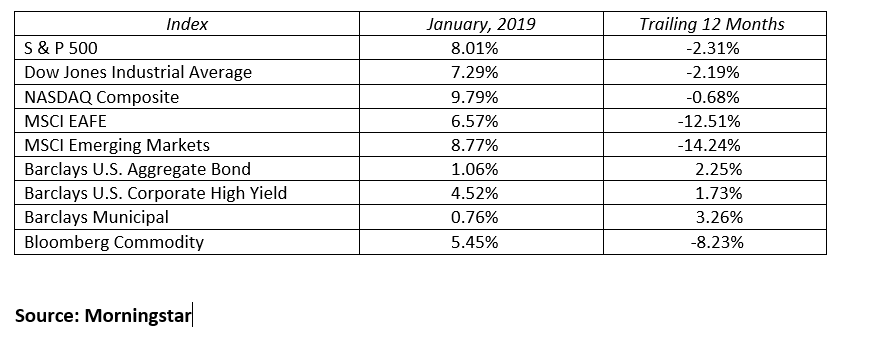

The January stock rally has been a traditional “risk on” trade as high beta and small capitalization stocks outperformed low volatility and large capitalization companies. This stock market turnaround has been a complete reversal from what we saw during the fourth quarter correction. Reported fourth quarter earnings and more importantly, 2019 earnings guidance, are behind many individual stock price movements. The market swiftly rewarded companies exceeding expectations (Apple, Boeing, IBM, Bank of America, and VF Corporation) and punished those falling short of expectations (Abbvie, Caterpillar, Bristol Meyers Squibb). The NASDAQ Composite, S&P 500 and the Dow Jones Industrial Average gained 9.8%, 8.0%, and 7.3% respectively in January. International stocks also had am impressive month as the MSCI EFAE and emerging markets indices produced gains of 6.6% and 8.8% in January.

The first Federal Open Market Committee meeting, held in late January, kept the fed funds rate unchanged as expected and the Fed reiterated their new found “wait and see” language. The stock and bond market has embraced the new and improved patient Fed. The benchmark 10-Year U.S. Treasury traded in a very tight range around a 2.72% yield, but rallied into month end after the FOMC meeting. It closed the month yielding 2.63%, down 6 basis point since year end. The yield curve retained its relatively flat, but still positively sloped shape. The 2-year Treasury fell by 3 basis points to end the month yielding 2.45%. Meanwhile, the 30-Year Treasury also fell 3 basis points to yield 2.99%. The yield curve shows a modest inversion at the 2-5 year segment of the curve, but for now, the overall curve remains positively sloped.

As we look ahead to the next eleven months of the year, here are the major themes we see playing out in the economy, stock market, and the bond market:

- The U.S. economy continues to expand, but at a slower pace than 2018.

- International economies display moderating, but still positive growth.

- Corporate earnings continue to grow this year in the 5-10% range.

- Interest rates remain relatively stable with the 10-year U.S. Treasury yield approaching 3%.

- The Federal Reserve will slow their pace of rate hikes this year (one 25 basis point move higher in the second half of the year).

- Stock market volatility remains elevated in 2019.

- Expect stocks to return 4-6% and bonds 1-3% this year.

Remain patient with your investment portfolio. Your patience will likely be tested a few times this year. If your portfolio is properly balanced at the appropriate risk level, you will be much better equipped to deal with the market’s volatility and subsequent emotional challenges. At the margin, investors can add some risk after a 10-15% correction and can reduce risk when the market revisits new all-time highs. In lieu of a marginal trading strategy, just peg your risk tolerance level and stay fully invested throughout tomorrow’s highs and lows.

MARKETS BY THE NUMBERS:

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222