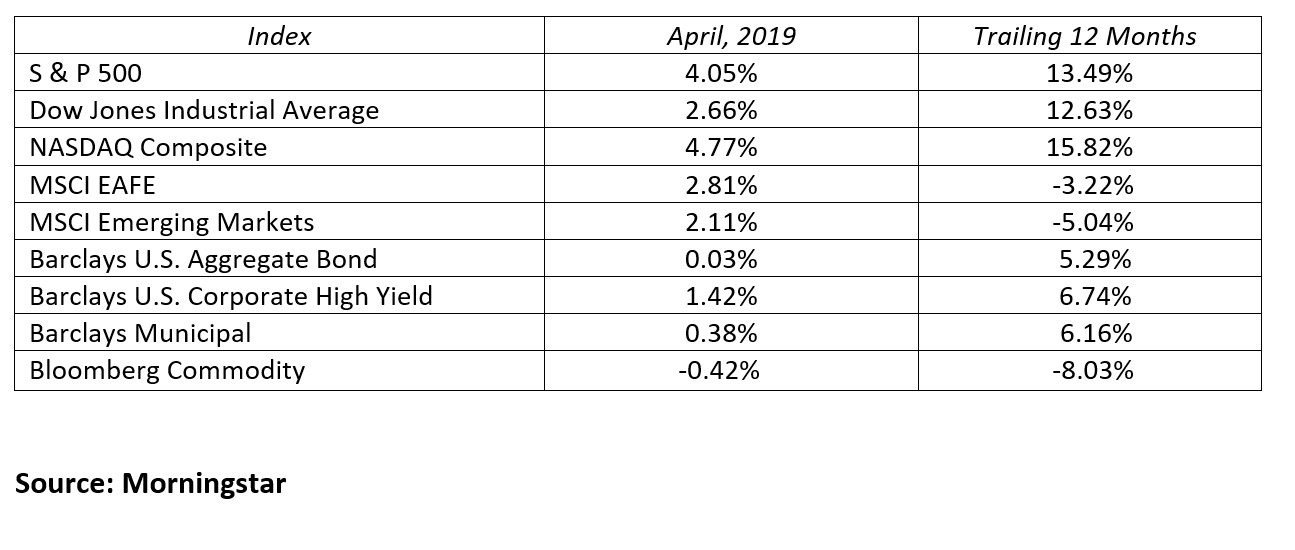

The fourth quarter pullback in stocks can officially be declared a correction as the 2019 version of this bull market took major U.S. stock indices to new all-time highs. The Federal Reserve’s pivot to a dovish monetary stance in early January has paved the way for stocks and bonds to prosper. The macro tailwinds from the economy and the Fed certainly help, but it is the individual company results that ultimately drive price. As you can see from the market returns below, everything was positive for the month with the exception of commodities. U.S. stocks continue to lead all global returns.

The first month of a new quarter means the market turns its attention to another round of corporate earnings releases. This quarter’s earnings are especially significant as the market tries to judge the magnitude of the expected slowdown in earnings growth. Wall Street is paying special attention to the company’s forward earnings guidance to better assess the full year 2019.

Companies reporting sub-par numbers are being punished by the market, while the winners are trading at all-time high prices. This month’s casualties included 3M, Intel, UPS, Alphabet and Exxon. On the positive side, strong reports from Walt Disney, Microsoft, Facebook, Apple and JP Morgan fueled gains. The early read on earnings is 78% of the S&P 500 companies have exceeded analyst expectations. An active IPO (Initial Public Offering) market has also provided a bullish tone to equities and 2019 is expected to be a big year for IPOs. April saw Lyft, Zoom Video, PagerDuty and Pinterest coming to the public market for the first time. Other large private companies including Uber are expected to issue public stock this year.

On the economic front, first quarter GDP reported a 3.2% growth rate, well above the 2.4% expected rate. The strong consumer is keeping us on solid footing as retail sales gained 1.6% in March, its largest gain since September 2017. The March employment number was back on track as 196,000 net new jobs were created. Monthly job growth averaged a respectable 180,000 jobs in the first quarter. Inflation, as measured by the Consumer Price Index, rose 0.4% in March. This was the largest bump in 14 months mostly driven by higher gas prices. The annual inflation rate at 1.9% is still running below the Federal Reserve’s 2-2.5% inflation target.

The bond market has been rock solid so far this year with the Fed calling a timeout to future rate increases. The Fed’s move to a dovish monetary policy coupled with continued low inflation, declining global interest rates, a strong dollar and stable economic growth has kept credit spreads tight and interest rates stable. The yield curve, while very flat by historical standards, is still hanging on to its positive slope. The 2-Year Treasury note yield finished the month exactly where it started at 2.27%. Meanwhile, the 30-Year Treasury bond added 12 basis points to yield 2.93%. Most of the yield curve now has interest rates lower than the very short-term fed funds rate currently set by the Fed at 2.50%. The benchmark 10-Year U.S. Treasury note again traded in a tight range hovering around 2.5%. In April, the 10-Year rose 10 basis points to end the month yielding 2.41%. The slight uptick in rates this month should not be a surprise after the strong rally in March.

The question all of us ask is, where do we go from here? Attention needs to be paid to corporate profits, future guidance and the path of the U.S. and global economies. Investors are assessing the strength of the economy to determine if it is softening or strengthening relative to expectations. At this moment in time, we believe the stock and bonds markets are priced appropriately. Future catalysts, be they positive or negative will drive prices accordingly. A trade deal with China, corporate earnings, Brexit, employment, inflation, the Federal Reserve and investor sentiment are all important. If you are a long-term investor with a solid financial plan these concerns or opportunities become less important. If you tend to be more emotional regarding market movements, these factors can be a concern. An intra year 10% correction is very likely, so do not be surprised if there is one before the end of this year. We are still positive on the long-term outlook and would encourage investors to also take a long-term approach.

To expand on these Market Reflections or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222.

To expand on these Market Reflections or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222.