The Wuhan coronavirus has been a major discussion topic for news outlets and sparked concerns of a global economic impact based on similarities to outbreaks like SARS, MERS, Ebola, and Zika in the past. Investors are trying to understand the business and economic ramifications that the virus could have on global supply chains and the impact to consumer consumption and industrial production.

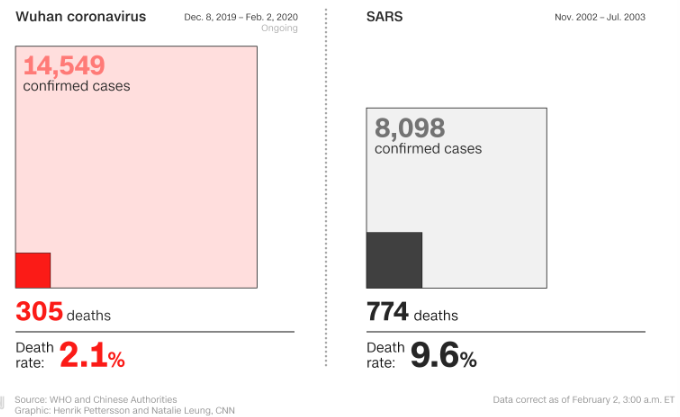

At the current time, the proportion of cases that end in death is much lower compared to SARS or MERS. According to Deutsche Bank, the death rate of SARS was approximately 10% while MERS was roughly 30%. The current Coronavirus death rate is 2.1%; a proportion similar to the fatality rate of the flu. Furthermore, the response to the outbreak, thus far, is much more coordinated and transparent than prior outbreaks. The graphic below from CNN1 depicts a comparison of SARS and the Wuhan coronavirus.

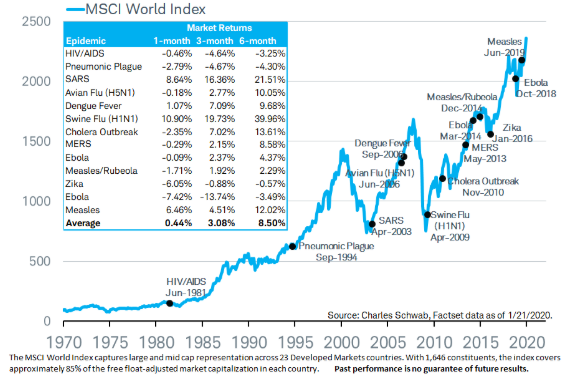

Fears of worsening trends in Coronavirus and the potential negative economic impact could provide an exogenous shock and cause a correction in global stock markets. However, if we gauge the impact of past outbreaks by the performance of the U.S. stock market, viruses have generally had a short-term negative influence and stocks have recovered and rallied afterward. The table and chart below from MarketWatch.com2 show the epidemic or outbreak and the subsequent change in the global market index.

We are still in the early stages of the virus and potential financial impacts are largely unknown. Also, China’s percentage of world GDP has grown significantly since SARS. Therefore, the integral role they play in the global supply chain and the increased consumption of their growing middle class could have a much more significant impact to businesses that are reliant on Chinese production or purchases from the Chinese consumer.

As a result, we cannot be certain on the effects the Wuhan coronavirus may have on the stock market performance in the short term. We will continue to monitor events as they unfold and will pay particular attention to what business management teams discuss regarding their growth outlooks and any changes to consumer behavior.

However, we continue to be constructive on long term trends in the stock market and history suggests that markets adapt as underlying conditions become more certain. Our suggestion is that investors conduct a review to examine their risk, rebalance to realign portfolios with the long-term objectives and potentially realize some profits from a strong 2019.

- https://www.cnn.com/2020/01/29/china/sars-wuhan-virus-explainer-intl-hnk-scli/index.html

- https://www.marketwatch.com/story/heres-how-the-stock-market-has-performed-during-past-viral-outbreaks-as-chinas-coronavirus-spreads-2020-01-22

To expand on these Market Reflections or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222.