Historically, stock markets have not reacted well to periods of great uncertainty that create a higher degree of question regarding the trends of future earnings. 2020 has certainly been a year of high uncertainty as a result of Coronavirus and the subsequent effects on the global economy. While investors are still dealing with the potential ramifications of Coronavirus and companies’ ability to adapt to “the new normal”, the elections in November are an upcoming secondary source of uncertainty.

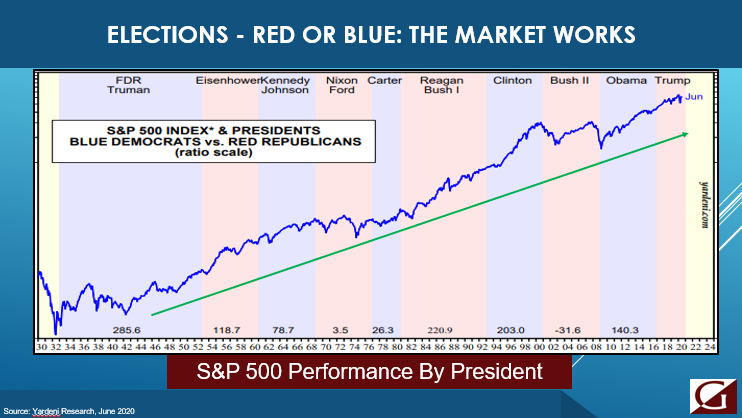

Whether we have continuity from the current administration, or a change in leadership, it is our opinion that markets tend to adapt and move higher regardless of who wins the election. Investors that mix politics with portfolios tend to perceive an unfavored political outcome as negative for their portfolio. Historically, however, the stock market performs well under Republican and Democratic administrations. In the chart below, the performance of the S&P (blue line) rises over time regardless what party is in charge. The light blue shaded area represents periods when a Democrat was President and the red shaded area represents time periods when a Republican was President. As you can see, the constant among both Democratic and Republican administrations is the ability for the market to grind higher.

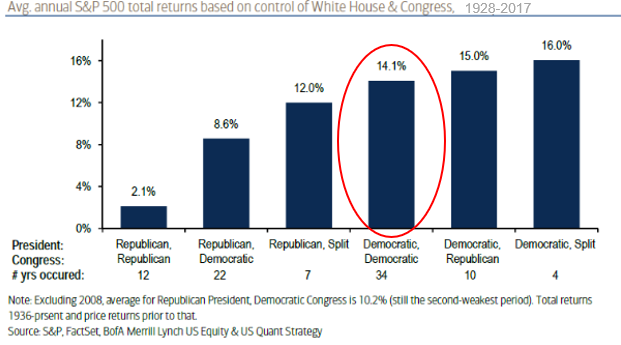

As we move closer to November, a lot of attention will be paid to election polls and predictions. The early election polling reflects a potential for a policy administration change. The initial consensus is that a Democratic sweep may be less business friendly than the current administration. While prediction of both the election and the resulting reaction of the market is extremely difficult, an examination of historical precedent can reflect how markets have performed during various scenarios.

As an example, history has shown if the Democrats sweep the presidency as well as congress, the returns for the S&P 500 on average are positive. In the graph below when a Democrat is President and Congress is also controlled by Democrats the average annual return for the S&P 500 going back to 1928 is 14.1% (red circle). While history is a good guidepost, it is never a certainty. Markets, and the companies within them, have shown a high degree of ability to adapt to various political environments and continue to provide value to their shareholders.

The upcoming election in November is yet another uncertain event with an unknown outcome. Uncertainty, however, is simply a part of investing and, over time, markets have proven adaptable and able to prosper regardless of which party controls the White House. It is Gradient’s opinion that politicians tend to have less influence on markets than most realize, and a well-defined investment plan tends to outlive political actions.

To expand on these Market Reflections or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222.