The summer of 2020 is coming to a close, the pandemic lives on, and the election is now in the spotlight with both political conventions completed in unconventional fashion. Major U.S. stock markets achieved multiple new all-time highs in August and now show positive returns for the year. Investors appear to be looking right through the current wall of worry and focusing on where the economy can go versus the current state of the economy. The markets seem to be brushing off the election, further impact from Covid-19, and national debt levels which have gone through the roof. Despite all the concerns and distractions, the stock markets appear to defy gravity on a daily basis.

The economic numbers released in August cannot fully explain the strength exhibited in the monthly stock market returns. The August unemployment report showed 1.8 million jobs added, in line with expectations. The unemployment rate fell to 10.2%, down from the previous month’s 11.1% rate. In September, the unemployment rate is expected to return to single digits, but it is still a long way from the 3.5% rate just prior to the pandemic. Inflation ticked higher for the month with the Consumer Price Index and the Producer Price Index each rising 0.6% on a month over month basis. Retail sales and durable goods recorded increases of 3.6% and 11.2% respectively.

The housing market has been the shining star in this cycle. The work from home dynamic along with social unrest in major cities and low mortgage rates has created an enormous demand for single family homes. The housing numbers in August were astounding:

- Housing starts were up 22.6%

- Existing home sales rose 24.7%

- 5 million building permits were issued

- Pending home sales increased 5.9% last month.

The pandemic has changed our lifestyles and behaviors in ways no one could have predicted just six months ago.

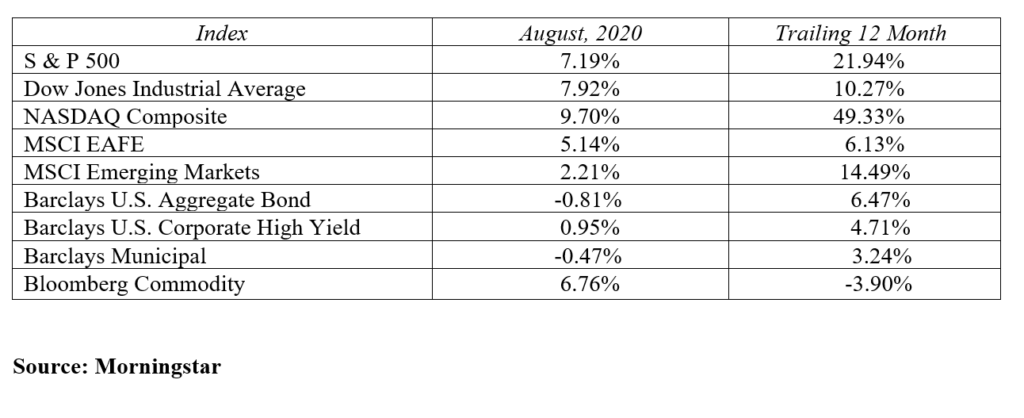

The stock market continues to move onward and upward logging the best August returns since 1984. Expectations for second quarter corporate earnings were low, but companies across the board reported better than expected results. In the retail space; Target, Walmart and Best Buy reported excellent numbers sending their stocks to 52-week highs. Federal Express and UPS were beneficiaries of the huge e-commerce wave. Big technology names like Apple, Amazon and Facebook continue to lead the NASDAQ Composite to new heights now trading at levels nearing 12,000. The S&P 500 is also trading at all-time highs with the five largest companies in the index (Apple, Microsoft, Amazon, Facebook and Alphabet) now representing over 20% of the index. The NASDAQ Composite returned 9.7% in August followed by the Dow Jones Industrial Average up 7.9% and the S&P 500 posted gains of 7.2% in the month. International stocks also had a profitable month with international developed stock markets rising 5.1% and emerging markets adding 2.2% in August.

The U.S. Treasury yield curve steepened in August as the short end of the curve is in a Federal Reserve induced lock down. This may not be the start of another seven-year zero interest policy by the Fed, but it could easily last for the next four years. The long-end of the yield curve is beginning to feel the pressure from mounting federal deficits. In August, the 2-year U.S. Treasury note rose 3 basis points to yield 0.14% at month end. At the longer end of the yield curve, 10-year note and the 30-year U.S. Treasury bond made a significant move to higher interest rates. Interest rates on the 10-year and 30-year rose 17 and 29 basis points respectively bringing their month end yield to 0.72% and 1.49%. Mortgage rates remain low helping to sustain the strong housing market. Credit spreads in both high yield and investment grade corporate debt narrowed marginally during the month.

Markets will likely be volatile as we head into the unknown of the November elections. The economic policies emanating from the two parties are vastly different and will impact both the economy and the markets well beyond 2020. The path of the pandemic will also influence business. Large corporations, like those in the S&P 500, are successfully managing their way through the pandemic while small businesses are taking the brunt of the storm. Collectively, small business employs a large percent of the country and as more small businesses permanently close, the employment rate will be negatively affected.

The past eight months is a perfect example of the market’s ability to whipsaw unsuspecting investors. Investors need to take a long-term balanced approach to their portfolio and overall financial plan. Markets move at speeds we never thought possible and it is imperative to position your investment portfolio at a risk level consistent with your investment goal and objectives. Set your course and stay your course for the long haul.

MARKETS BY THE NUMBERS:

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222