As we are nearing the end of winter and beginning of spring, optimism among investors seems to relay an expectation of sunnier days ahead. With continued stimulus measures from the government combined with a new vaccine entrant in the battle against COVID, market performance has clearly favored assets levered to recovery at the expense of “safe haven” assets and companies that have benefited from a higher degree of restrictions.

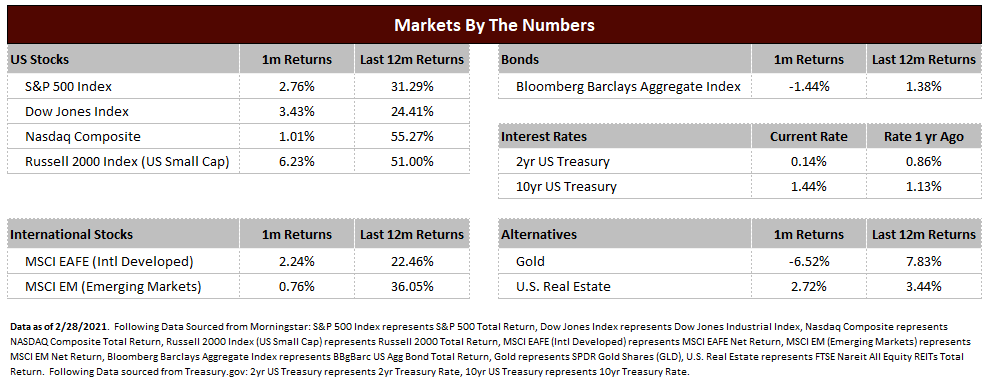

In the bond market, the Barclays Aggregate Bond Index is firmly in negative territory to begin the year. The primary reason for bond weakness has been the rise in U.S. treasury rates, especially at the long end of the curve. The 2-year U.S. treasury rate, which tends to be much more correlated to the Federal Reserve fed funds rate, has stayed consistent at 0.11% at the outset of 2021 and closed February at 0.14%. The 10-year U.S. treasury rate, however, has climbed from 0.93% at the beginning of the year to rise to 1.44% by February month end. Longer dated treasuries tend to be driven by expectations of economic growth and inflation, and the sentiment on each has been rising this year. When rates rise existing bond prices fall, and the longer maturity assets fall more aggressively. That is exactly what we are seeing in the bond markets now, as long maturity treasuries have significantly underperformed their shorter maturity counterparts. The move away from “safer” assets can also be witnessed in the price of gold, which has declined over 8% year-to-date.

The market rotation has been toward investments benefiting from increased economic activity. Oil prices are up over 25% year-to-date and stocks in the oil and gas industry have been among the best performers of the year thus far. Bank stocks are also up significantly in 2021 as they tend to profit from greater economic growth and a higher spread between short and long-term interest rates. February also witnessed multi-year highs in commodity assets like copper and lumber, which benefit from increased economic growth and speculation of higher infrastructure spending.

Currently, both fiscal and monetary policies are geared toward expansion over restriction. The House of Representatives recently passed legislation on another round of stimulus and consensus opinion is that some version will be enacted in March. Meanwhile, the Federal Reserve met in February and continued with expansionary policies that include buying bonds in the market and keeping short term rates near zero. While substantial stimulus measures will have long term ramifications for inflation and certainly greater U.S. debt levels, the new administration and the Federal Reserve clearly have no intentions on pumping the brakes on the economy anytime soon.

As we continue through the year, our team will monitor interest rates as a key driver for the markets. Currently, we are not in an area that is dangerous to continued economic growth or to stock market valuations. If rates continue to dramatically rise, however, they can have a negative effect on the stock market as investors become worried about runaway inflation or just begin to rotate back toward bonds given their higher income.

During times of high speculation and with significant increases in certain assets, there is always a temptation to abandon investment plans and chase higher returns. It is human nature. As always, it is our opinion that investors should remain focused on their long-term objectives that blend with their circumstances and risk tolerance, stay diversified with both growth and safe assets and remain nimble to market opportunities as they present themselves.

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222