Stocks have been strong in 2021 across nearly all regions and sectors. As markets have hovered around all-time highs, one prevalent trend is value stocks outperforming growth stocks. The S&P 500 Value ETF (IVE) has returned 17.63% in 2021 while the S&P 500 Growth ETF (IVW) has returned 8.19%. This trend is relatively new, as the 3-year annualized performance of growth stocks at 20.9% still far exceeds that of value at 13.6%. Much of the value stock outperformance has derived from the higher degree of “recovery” based stocks in cyclical sectors like financials, energy, industrials, and materials compared to the heavy technology weighting in the growth universe. Whether this trend is sustainable will largely depend on technology stock performance and the valuation investors are willing to pay for the large companies in that sector.

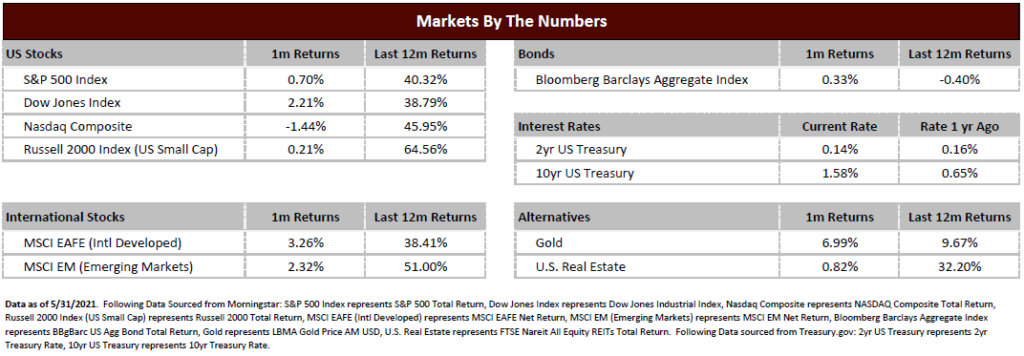

Long-term interest rates have been trending slightly downward, with the 10-year US Treasury rate ending May at 1.58% after peaking at 1.74% in March. Short term rates, which are much more controlled by the Federal Reserve, remain at or near zero. As we go through the remainder of the year, job growth and inflation rates will be significant determinants of long-term interest rate trends, and our opinion is that economic data would suggest higher rates later in the year. The Federal Reserve has given several indications of allowing inflation to remain elevated in the near term to ensure the economic recovery is on solid footing. Further, no Fed actions to slow or curb either inflation or growth have been enacted as of yet.

As we begin to enter the summer months, much of the market analysis will be focused on the economic ramifications of loosening restrictions and the resumption of “normal” activity for a broad swath of US citizens. Vaccination levels have increased, with recent reports suggesting over 50% of US adults have now been vaccinated paired with a current administration target of 70% with at least one dose by the Fourth of July. Vaccination data varies across the states and expected future COVID impacts are likely to be more targeted and regional compared to countrywide as seen in the recent past.

Further, the end of June will reflect the end of the second quarter in 2021, which also provides an anniversary of the most significant economic shutdowns due to COVID. After this quarter, company earnings and the economy will begin to compare against recovery instead of shutdown, and company outlooks for the second half will give investors a better sense of the magnitude of economic acceleration.

As we stated last month, markets have been incredibly resilient after the severe correction of March 2020. There have been very few instances of corrections during this time even as economic data has been more uneven. We are clearly in economic growth mode, but despite inflation concerns as a result of capacity constraints and high demand, investors have been steadfast in buying the slightest of market dips.

These types of markets rarely last forever. Enjoy them while they happen but understand that volatility is a function of the market and will return at some point in the future. This will invariably create a correction as new worries replace the old fears that either subsided or have been concluded. This is natural and part of the investing process. Timing this change in trend with an all in/all out strategy is incredibly difficult to do and not recommended. While we do emphasize prudence over aggression at this time, we believe market fundamentals are on solid ground and would look to market corrections as future opportunities.