When reflecting on the markets during the first half of 2021, it is important to understand both where we are and where we were at this point last year. To be clear, we are not completely done with COVID as a concern, but the data continues to trend positively, and recovery is no longer imminent but is here and now.

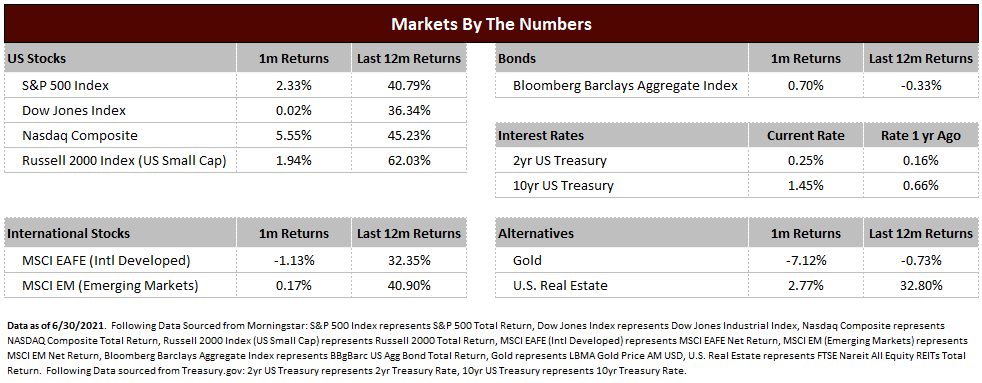

As the stock market tends to be a forward-looking mechanism, prices reflected an economic recovery well before it actually occurred. Over the last 12 months, US large cap stocks are up over 40%, US small cap stocks have increased over 60%, international developed are up over 30%, and emerging markets have risen by over 40%. We are believers in fundamentals – including the health of the economy and company earnings growth – as the primary drivers of markets over the long term. With a significant rebound in GDP, strong jobs growth, and corporate earnings that are exceeding expectations by record levels, there is no doubt that the fundamental factors have been as strong as they have been in a long time.

The strength of market performance that has happened recently often comes with concerns about the future. The primary point of concern so far has been inflation. There is little doubt that inflation is present as a result of recovery-influenced demand and continued constraints on supply as a result of COVID. Certain pockets of extreme price increases (examples being lumber and copper) have been used as talking points for whether inflation is overheated and if the US Federal Reserve needs to change course to control rising prices. It is our expectation that inflation will remain elevated for the remainder of the year, but we don’t see a reoccurrence of the high levels of inflation witnessed in the 1980’s.

One of the surprising occurrences of the first half of 2021 has been the direction of long-term interest rates. It was both the consensus and our expectations that rates would rise this year as a result of economic recovery. This has been proven accurate thus far as the US 10-year Treasury rate has risen from 0.93% at the end of 2020 to 1.45% at the end of June. What has been surprising is the direction of rates in the second quarter. The 10-year Treasury rate crested at 1.74% on March 19th but has subsequently fallen despite data showing continued economic growth and rising inflation. These are typically catalysts for rates to rise, and as we expect these economic trends to continue, our stance remains that long term rates are more likely to rise than fall in the second half of 2021.

As we enter into the second half of the year, questions about what drives markets forward are changing as well. We are less driven by COVID related data, and absent an unforeseen change in trend, we wouldn’t expect COVID to be the primary concern going forward. The new questions for the markets are now more focused on classic concerns regarding economic growth trends, company earnings and outlooks, the trend of interest rates, and subsequent actions by the Federal Reserve.

Again, our examination of the long-term direction of the market is based upon fundamentals. Our opinion is that fundamentals will remain strong as the economy continues to be driven by the resumption of activity by the very powerful and quite healthy US consumer. This tends to be favorable to continued market expansion. However, this does not mean the market won’t face difficult times or avoid corrections. Progression higher in the markets is rarely smooth and steady. There are often choppy waters even as the direction remains on track. Corrections should be planned for and expected. Volatility will return at some point. We cannot tell exactly what will cause this beforehand nor when it will occur, but the history of markets suggests this is a near certainty.

Despite the potential resumption of volatility in the markets, our long-term investment approach remains steadfast. Stay invested for the long term, have an investment plan that incorporates both safe and growth assets, and remain nimble to market changes and future opportunities.