Within Nevada Retirement Planners, we have two stock based strategies, the Gradient 50 (G50) and the recently introduced Gradient 40 International (G40i), that emphasize dividend income as part of their value proposition. In today’s market reflection, we are going to provide you with our thoughts as to why dividend based investing provides long-term portfolio value.

Reason #1: Dividends generate income in a low yield environment

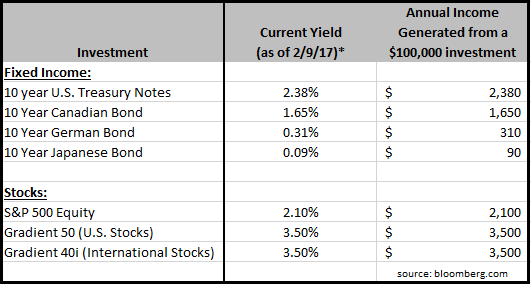

The current yield on a 10-year U.S. treasury note is 2.38%. This is near a 30 year low. In other countries, 10-year yields are even lower. The data shown below illustrates the current yield and annual income generated from a $100,000 investment in each particular country’s debt. The data also reflect the current dividend yield and annual income generated from a $100,000 investment in the S&P 500, the Gradient 50 (U.S. stocks) and Gradient 40i (international stocks) portfolios. In this low yield environment, an allocation to select stocks that pay consistent dividends can generate additional income to supplement the payments received from fixed income investments.

Reason #2: Dividends have the ability to outpace inflation

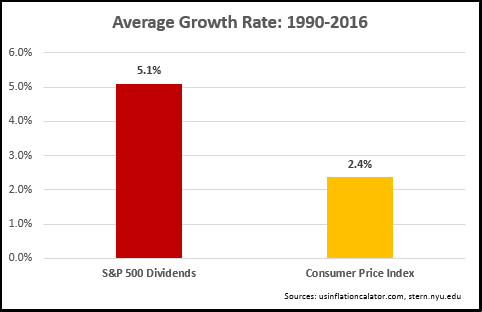

With fixed income coupon payments, the amount of payment generally stays the same through maturity. Over time, prices of goods and services tend to rise (inflation), and the result of rising prices means the fixed coupon payments become less valuable – investors lose purchasing power. Dividends from stocks have the ability to outpace inflation as many companies can, and do, raise their dividends over time. As the chart below shows, the average dividend growth rate of stocks (represented by the S&P 500) has outpaced average inflation (represented by the Consumer Price Index) since 1990.

Reason #3: Dividends can provide defense in turbulent markets

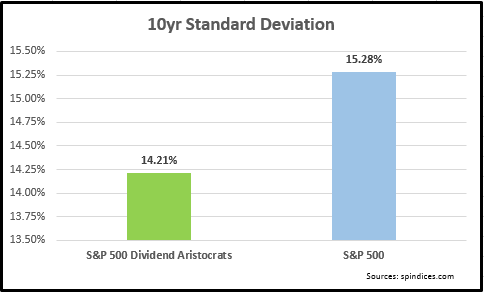

The majority of dividend paying companies tend to be large, relatively stable companies within defensive industries like Consumer Staples, Telecommunications, and Utilities. Over an extended period, these companies tend to exhibit less volatility compared to the broad market. This can be shown by looking at comparable standard deviation over time. Standard deviation tends to be the preferred method to measure market risk, where higher standard deviation represents higher risk. The below chart reflects the standard deviation of a dividend paying portfolio (the S&P Aristocrats Index) versus the broad market (S&P 500). Over the last 10 years, the data shows that the S&P 500 Dividend Aristocrats have had consistently less average risk compared to the broad market.

Reason #4: Dividend paying companies provide income and price appreciation potential

When an investor purchases a bond, the expectation is to receive coupon payments during the time of holding and receive a return of principal at maturity. When an investor purchases a dividend paying stock, there is an opportunity to benefit from price appreciation of the underlying during the holding period. Investing in stocks does involve increased risk, but over extended periods the stock market tends to appreciate. As a result, investors can be rewarded with both dividend income and a return on their initial principal investment.

Risks to dividend stock investing

While we at Nevada Retirement Plannners believe in the long-term benefits of dividend stock investing, we would be remiss not to point out some of the risks. Unlike fixed income coupon payments, dividends are voluntary payments from companies and can be reduced or eliminated in times of stress. Second, with fixed income instruments, there is an implied return of principal at maturity unless the entity is subject to default. When investing in stocks, the principal amount may increase or decrease, and invested assets typically display higher volatility (or increased risk) compared to fixed income investments. These risks should be factored into the overall asset allocation strategy that is based on an individual’s return needs, risk tolerance, and investable time horizon.

In summary, an allocation to dividend paying stocks is a proven investment strategy that can provide growth and income for investors over time. An allocation to dividend paying stocks, both U.S. and international, can provide supplementary income to meet investor needs as well as the opportunity to grow assets over time. While not without risk, we believe dividends are a valuable source of portfolio returns, and we continue to recommend dividend paying stocks as part of our investment allocation strategy.

To expand on these Market Reflections or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222