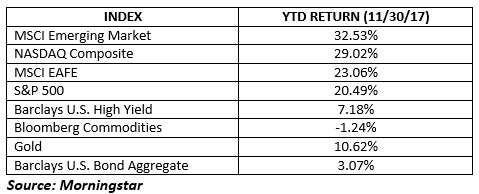

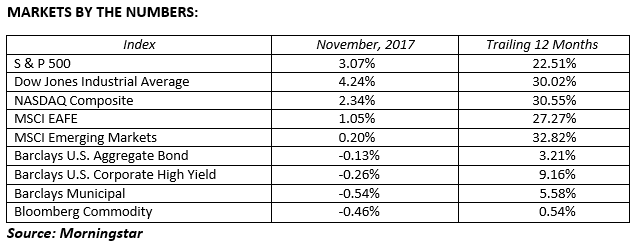

As the markets hit the final stretch run in full stride, there are only 20 trading days left to reach the 2017 finish line unscathed. It has been a remarkable year and another remarkable month for the financial markets. All asset classes are producing positive returns through November, and the stock markets refuse to pull back from this aggressive pace. Let’s take a quick look at the year to date performance on some key indices.

The Gradient Investment portfolios are also looking for a strong finish to the year. Our portfolios are managed to deliver a targeted risk level. So far in 2017, our higher risk portfolios are outperforming lower risk portfolios. This is not a surprise in a year rewarding risk takers. Remember, our advice is to never chase performance. It’s better to maintain a proper mix of portfolios, weighted to an appropriate risk level for each individual investor.

The Gradient Tactical Rotation and the G33 are our best year-to-date performers with returns running north of 20% through November. So far this year, growth companies have been well rewarded and value companies have trailed their growth counterparts. This fact has been well documented in our past communications. Our G50 and G40i portfolios are well positive through November, but lagging pure growth portfolios. Our fixed income expectations coming into this year were for low single digit returns. The Absolute Yield and Fixed Income Portfolios are on pace to deliver on this forecast.

December will be a key month in determining the setup for 2018. With third quarter corporate earnings season successfully in the books, market attention will turn to a handful of key policy and political factors. Let’s take a look at what is ahead for the markets;

Tax Reform – Does a tax reform bill come out of the senate and will it become law? Your educated guess is as good as mine, but I believe the stock market has priced in the expectation for lower corporate and personal tax rates. If this does not get passed, the stock market (especially small cap stocks) will be disappointed and ripe for an overdue correction. If passed, this should be good news for the U.S. economy helping both consumers and businesses. The stock market should smoothly sail into 2018 should Washington create a more competitive tax environment.

Government Shutdown – We have been down this road before, and experience tells us the stock market is not fond of government shutdowns. Today’s national politically charged environment does not make funding the government any easier. Complex issues ranging from immigration, repeal of Obamacare, funding the wall, and hurricane relief will provide every side with a reason to disagree. This may prove to be a tough hurdle to clear by the fast approaching deadline.

Federal Reserve – Jerome Powell has been nominated to be the next Chairman of the Federal Reserve replacing Janet Yellen when her term expires in early 2018. The partisan confirmation process will be in full force in December. Also the Fed has a December meeting where expectations are set for a 25 basis point fed funds rate hike. Higher short-term rates and yield curve flattening likely continue into 2018.

Geopolitical Risks – The market lives with these risks every day and has yet to be shaken by the events of 2017. Unfortunately, it only takes one event to send shock waves through the markets. Let’s hope the markets don’t have to deal with any irrational acts of violence.

If the markets can avoid these potential December pitfalls, we can get to January and make corporate revenues and earnings the focus again. A new earnings season and revised forecasts for fiscal year 2018 could once again give this bull market more room to run, as revenues are expected to grow at 5% and earnings to grow at 11%. Before we project 5-11% growth in the stock market next year, let’s see how the financial world handles these critical December events.

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222