The US stock market, as measured by the S&P 500, continues to set new record highs rising more than 18% to start the first half of the year. The strong start in 2019 has recouped the poor performance of late 2018 as the stock market continues to set new highs. For the last decade, the stock market has consistently marched up, but has displayed some volatility along the way. This volatility (illustrated by the gold circles) can be seen in the chart below from StockCharts.com.

The question we often get: “Is it too late to invest in the stock market after the strong start to the year?” That same question has been asked many times the last decade. Looking at the results it wasn’t too late to invest at any time the past decade. There will always be corrections in the market, but we feel the market will continue to grind higher over time. None the less, it may not be as smooth as it has been the last decade as volatility has picked up recently.

Some of the factors that give us comfort the stock market can continue to advance are:

- The economy is still growing

- The Federal Reserve has become more accommodating recently

- Valuation is still reasonable

One of the common metrics for judging the strength of US economy is looking at US GDP (Gross Domestic Product) which is expected to grow around 2% for 2019. With economic growth still positive and unemployment near record lows, we feel the backdrop for stocks is still positive.

The Federal Reserve last month signaled a more dovish tone, putting interest rate increases on hold and adding the possibility of interest rate cuts. A lower interest rate environment is generally thought to be a positive for the stock markets.

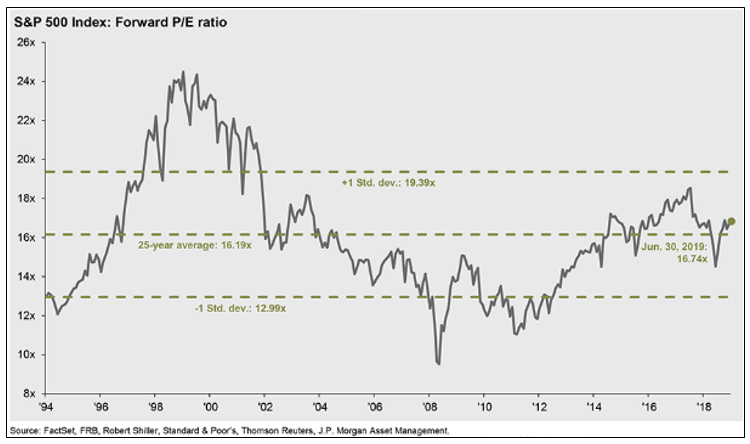

With the large stock gains of the last decade, one would think the stock market is wildly overvalued, but that is not the case looking at forward P/E multiples. P/E multiple is a valuation metric that looks at the price of a stock (the P) divided by the earnings (the E) of that company. JP Morgan looked at forward P/E multiples of the S&P 500 for the last 25 years shown in the following chart.

The latest P/E multiple on the S&P 500 is 16.7x which is slightly above the 25-year average of 16.2x. While the stock market is not cheap, its valuation is only slightly above its 25-year average, which we believe is reasonable.

In summary, while the US stock market has performed well to start the year, we believe the conditions are in place to for the S&P 500 to continue to increase in value going forward. Stock market performance may be more volatile than the past decade, but the fundamental drivers are still in place for markets to move higher.

To expand on these Market Reflections or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222.