As we progress through 2019, one of the predominant themes has been the dramatic reduction in interest rates across the globe. While interest rate cuts are meant as an elixir to struggling economies, it also has the effect of lowering rates of return for bonds and other safe assets. As a result, many investors are left with questions on how to generate income in their portfolios while staying within their personal risk profile.

In the US, interest rates have been declining precipitously. Per the chart below, US 10-year treasury rates have decreased from a recent high of 3.22% on November 2, 2018 to 1.55% on August 16, 2019.

Further, August 14, 2019 saw the 30-year US treasury hit an all-time low yield of 2.06%, per Marketwatch.com.

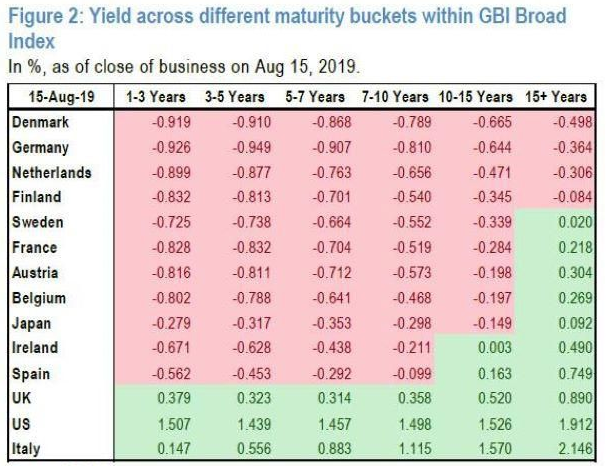

When US rates are declining aggressively, it makes existing bonds more valuable (as they are paying higher than current market rates) but creates lower return for new bond investors (or those that are reinvesting proceeds from matured bonds). A perfectly suitable alternative, historically, was to look to international bond markets for potentially greater yield. At this time, however, many international markets are paying NEGATIVE YIELDS, which means that you will receive less money at maturity than you are investing today. The chart below, from JP Morgan, shows the current yields for government bonds for several different countries. The bonds highlighted in red currently have negative yields:

A logical question is why anyone would invest in a negative yielding bond. The answer is that speculators buy these bonds as they expect rates to go lower, thus making their negative yielding bond more valuable in the short term. In our opinion, this is a dangerous game that does not seem sustainable over the long term. So, for investors looking for additional income in a low/negative yield world, here are some of our suggestions for alternatives:

- Dividend paying stocks: Our G50 and G40i portfolios are currently generating above 3% per year in dividend income. Further, the companies we invest in are healthy companies with long term track records of paying, and increasing, their dividends. This dividend increase is a powerful force to offset the effects of inflation and provide a greater amount of income over time.

- Alternative income assets: Alternative assets that lie outside traditional stocks and bonds are investments such as REITs, preferred stocks, and senior bank loans. These assets are generally higher risk than traditional bonds but offer a higher recurring income source. Our Absolute Yield portfolio is a terrific example of a diversified asset allocation strategy that invests in high income assets and is currently yielding over 5%.

Overall, if investors want additional income in the current market, they will have to accept higher risks. We would not expect a lot of return from traditional bonds at current levels, but they still have a place in client portfolios as a means of risk reduction. US treasury and US corporate bonds, despite the recent collapse in interest rates, still provide positive relative income and can offset volatility from riskier investments.

To expand on these Market Reflections or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222.