Last week, Gradient Investments held its annual Elite Advisor Forum. In this forum, we gather advisors and experts from across the country to discuss hot button topics in markets and trends in the asset management business. Here are some of the topics discussed.

The Search for Yield

The search for income in a negative rate world was a significant point of discussion. This is a topic we have also covered in prior market reflections. Thomas Wood, Director for Blackrock, shared that nearly 25% of global government bond yields are now in negative yield territory. Paul Blomgren, Portfolio Manager with Nuveen, suggested that slower global growth, controlled inflation, and geopolitical risks are likely to keep a “lid” on interest rates.

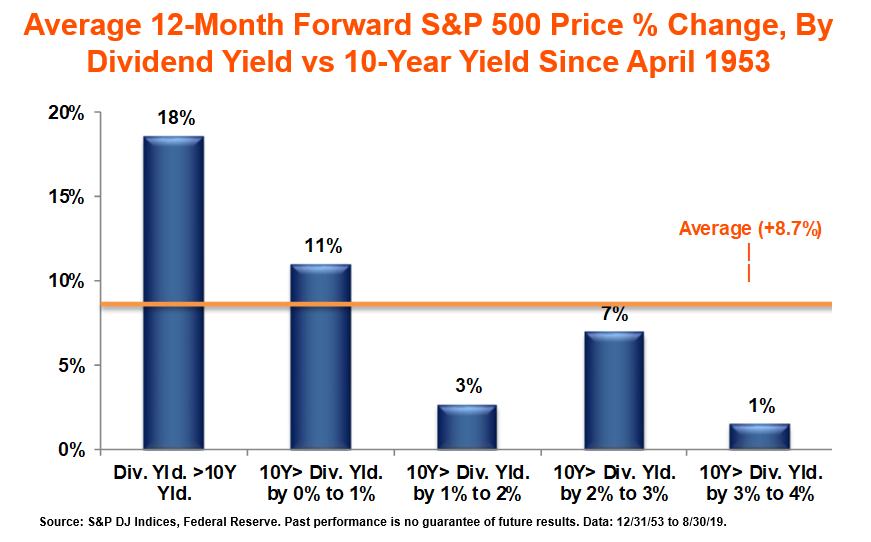

An alternative to bond income is dividend paying stocks, like the holdings in our G50 portfolio, given the negative interest rate environment. The below chart presented by Sam Stovall, Chief Investment Strategist from CFRA research, reflected that market performance has often been positive when the S&P 500 dividend yield exceeds the 10-year US Treasury rate.

Politics and Portfolios

Another widely discussed topic was the upcoming presidential election and the impact on the markets. Stu Sweet, President of the Washington DC advisor Capitol Analysts Network, provided some insight into the current situation. He suggested the “battleground” states to watch in 2020 remain Florida, Wisconsin, Michigan, and Pennsylvania.

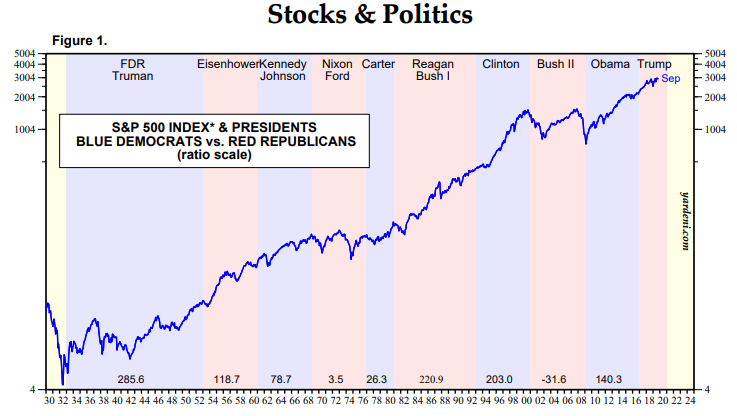

Overall, however, recommendations were consistent with Gradient’s position regarding investing based on politics: portfolio decisions and politics are best left separate. There are always issues and concerns in the markets, including elections, but that doesn’t require a need to deviate from your customized investment plan. Below is a chart from Yardeni Research that shows stock market performance during Democrat (blue) and Republican (red) presidencies. As you can see, markets tend to work for either and allocating based upon who may or may not occupy the White House is not a recommended strategy.

Investment Outlooks

Regarding the stock market, most were positive on the US market but with expectations of continued volatility in the short term. Brian Belski, Chief Investment Strategist from BMO, believes we are in the middle stages of a long-term secular bull market that has significant future upside even with increased short-term volatility. Mr. Stovall echoed similar sentiments by stating his case as a “bull with a small b”. His thought was that while there is an increased threat of recession on the horizon, his base case is US GDP growth above 2% next year and a stock market with upside potential from current levels.

At Gradient, we remain constructive on stocks but caution investors to temper future expectations given a very strong market in 2019. We are cautious on bond markets overall and would not be chasing significantly higher bond risk for a very small amount of incremental income. For clients who are willing to tolerate more risk, we believe dividend stocks like our G50 or our income focused Absolute Yield portfolio are attractive alternatives. Lastly, for investors looking for some protection from near term volatility, the Gradient Buffered Index Portfolio is designed to participate in market upside but also provides some downside protection.

To expand on these Market Reflections or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222.