The new decade began with the same unrelenting upward price momentum that closed the previous decade. With the news cycle in overdrive, the financial markets received breaking news with open arms and continued its march to Dow 30,000. It took just 40 trading days for the Dow to climb 1,000 points from a 28,000 close to a 29,000 close. The resiliency of this market must be respected as it powered through rising geopolitical risks on its way to new all-time highs. The outbreak of the coronavirus in China and the spread of the disease halted the global stock market rally. Year to date gains were quickly erased as the markets tried to assess the virus’s implications for longer term global economic growth.

The military strike in Iraq against the top Iranian military officer and Iran’s subsequent response shocked the market for a moment. An overnight sell-off on the heels of the Iran response sent the Dow down 400 points. This price action was reminiscent of election night 2016. By the time the market opened in New York, the losses were erased and the market moved higher on the day. Oil prices hit an intra-day peak not seen since last April and then retreated once it became clear that de-escalation was the path forward. Oil continued that slide into month end as the virus spread. The market also processed impeachment, the signings of the phase-one China trade deal and the U.S. Mexico Canada Agreement (USMCA), mostly positive economic data releases, and the early rounds of corporate earnings announcements for the fourth quarter.

The December jobs report released in early January showed 145,000 jobs created while the unemployment rate held steady at 3.5%, a 50-year low. Wages grew less than 3% year-over-year for the first time in 17 months. These numbers were slightly below expectations. The broader U-6 jobless rate, which also includes the underemployed, declined to 6.7%, the lowest in 26 years of recordkeeping. The details below the headline numbers supported the trend of weakness in the manufacturing sector and strength in the service sector. Homebuilding showed a huge pickup when the Census Bureau reported a 16.9% surge in housing starts in December. The bottom line here is consumers are employed and able to spend their money on goods, services and housing. The advance read on fourth quarter GDP growth was reported as 2.1%, right in line with expectations. All these factors should support the economy well into 2020.

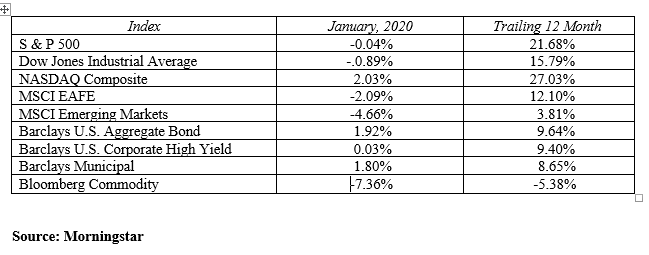

There is an old Wall Street adage that states: “As goes January so goes the year”. Based on this January’s volatile price action the markets could be in for an interesting year. For the month, the NASDAQ Composite rose 2.03%, but other major indices slid into negative territory. The S&P 500 declined 0.04% and the Dow Jones Industrial Average fell 0.89%. International stocks also fell ill to the coronavirus. The MSCI’s international developed markets index and MSCI emerging markets index were down 2.09% and 4.66%, respectively. Today’s headlines will pass, and the market’s focus will return to corporate earnings once again. Last year earnings were flat on a year over year basis, but stock prices advanced on valuation expansion. This trend cannot continue unabated. Earnings will need to grow in 2020 to justify the current price-earnings ratios. Profits will be the key to future stock price movements. Analyst expectations for 2020 corporate earnings to range from zero to ten percent growth. Obviously for the market, higher earnings are better. If Apple’s and Amazon’s record fourth quarter is any indication of the future, the stock market would be on solid footing.

The bond market is flying below the radar as investor attention is squarely on stocks. The Federal Reserve is likely on the sidelines this election year. At their January meeting, the vote was 7-2 to keep rates unchanged with the two dissenting votes calling for a rate cut. Interest rates were remarkably stable as the stock market surged and then headed lower as fear of the virus worked through the market. The year ended with the 2-year, 10-year and 30-year U.S Treasuries yielding 1.58%, 1.92% and 2.39% respectively. These were basically the high water marks for the month as rates declined dramatically from there to finish January yielding 1.33%, 1.51% and 1.99%. We expect low and stable interest rates to be the path forward in 2020. For interest rates to breakout higher, inflation would have to accelerate. Higher wage inflation or an unexpected rise in the cost of goods and services would put upward pressure on interest rates. For rates to move significantly lower, it would take a recession or a global crisis to put downward pressure on interest rates. Return expectations for bonds should be consistent with the yield on the underlying bond investments. Our outlook for bonds is interest rate stability and an “earn the coupon” year for bond investors.

We think patience will be a virtue that rewards investors at these levels. It can be argued that stocks are fully valued based on what is known today, but there are catalysts in the wings which can advance this bull market through 2020:

- Impact of continued low interest rates

- Implementation of USMCA and the phase one trade deal with China

- Strength in the housing market

- Growth in corporate earnings

- Potential for tax cut 2.0

Remain patient. Don’t let the news of the day scare you out of the market or embolden you to dial up the risk in your portfolio. Stay invested at a risk level matched to your needs and your personal risk tolerance. As we have written before, portfolio rebalancing is your most powerful tool. Use current market strength to your advantage and adjust your allocation to stocks and bonds in your portfolio back to your target allocation. Proceed with a long-term patient and thoughtful focus to achieve long-term rewards.

MARKETS BY THE NUMBERS:

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222