Time quickly marches on. With the calendar year halfway behind us, it’s a great time to review the known and to anticipate the unknown. Entering 2015, we had a basic set of expectations for the new year. We predicted stocks to generate single digit returns in the low to mid range for the full year and bonds would deliver low single digit returns. We are now at the midway point, and these annual expectations are still realistic.

Due to a variety of factors, both the U.S. and global stock markets ran into some near-term obstacles. As global interest rates rose and the U.S dollar strengthened, corporate profits grew marginally, which created a cautious atmosphere in the financial markets. June’s price declines and higher price volatility can be attributed to Greece’s financial woes and ultimate bond default.

In the U.S., stock valuations are now a bit stretched as the forward 12-month price-to-earnings (PE) ratio for the S&P 500 companies is 17 times. This is above both the five and ten year historical PE averages. Simply stated, the stock market needs to buy time until better future earnings can support these valuations. International stocks may well be setting up for future outperformance as foreign central banks are implementing a U.S. style easing program, but country specific financial stress could postpone a rally. The remainder of 2015 may very well be about getting to 2016. In 2016, the year over year comparisons will become more market friendly as both the increasing dollar and the declining price of oil will have been over a year in the making.

In the U.S. bond market, the mantra has been a call to higher interest rates. While the Federal Reserve has opted to stay the course for now, the market took it upon itself to allow longer term interest rates to rise. For the calendar year, the short end of the yield curve is unchanged and longer maturity rates have moved marginally higher. The 10-year U.S. Treasury climbed 23 basis points to yield 2.35 percent and the 30-year is up 42 basis point to yield 3.11 percent.

The Federal Reserve would love to return to a normal monetary policy but the Fed needs stronger economic data to support future rate increases. The data is moving in the Fed’s direction, but is not yet strong enough to invoke a rate hike. While the much anticipate June rate increase did not happen, September or December is ripe for one 25 basis point hike in the federal funds rate. The eventual rate hike will likely be a symbolic move whereby the Fed can state they ended their zero rate interest policy and have returned to a normal monetary stance. Unless the global economic data really heats up, the Fed’s first rate hike may be a “one and done” for a while.

At the end of the day, investors need to be invested. With cash yields frozen at zero, your choices are to either sit on the sidelines with inflation quietly eroding your purchasing power or to invest with a long-term purpose. Being a long-term investor with realistic expectations is the right answer. Bond yields are low and likely to stay there so expect annual returns in the two to three percent area. Stocks offer long-term growth opportunities, but given current valuations expect mid to low single digit returns as we move toward the end of this year. Keep your portfolio invested within your comfort zone and stay two steps ahead of inflation.

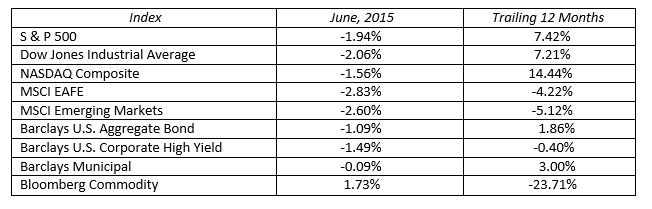

MARKET BY NUMBERS: