The third quarter had something for everyone. In July, the bulls gloated as the S&P 500 soared to multiple record highs after Brexit concerns quickly faded in the rear view mirror. In August, the markets displayed their typical summer doldrums with low volatility, sideways price action and tight trading ranges. In September, the bears briefly poked their heads up to remind everyone prices can also go down when volatility comes out of hibernation. In the end, the markets once again proved they are resilient.

The resiliency comes from favorable market fundamentals and accommodative central bank policies around the globe. Low short and long-term interest rates continue to support the prices of riskier assets. With interest rates at generational lows, investment is being diverted into riskier assets to achieve a reasonable return. The flow of money into global stock markets is a major reason behind the sustained rally. In addition to low interest rates, corporate profits are improving and the economy is grinding out slow and steady growth. Employment numbers are showing improvement bringing consumer confidence to a nine year high. A strong consumer usually means a strong stock market.

The U.S. Federal Reserve speaks often, but is starting to sound like the boy who cried “wolf”. This is the third quarter this year where the threat of a 25 basis point rate hike remained a threat. In defense of the Federal Reserve, they find themselves in a difficult place. The U.S. is void of any fiscal restraint, and monetary policy alone has limitations. Low and even negative interest rates globally impact the Fed’s ability to raise U.S. short-term rates. While the Fed claims to be non-political, they know an election is just around the corner and would prefer to remain neutral. We expect a 25 basis point hike in December after the dust settles.

As the markets enter the home stretch of 2016, expect the unexpected. Valuations in the stock and bond markets are rich by historical standards. If third quarter earnings beat expectations and interest rates remain low, then the market becomes fairly priced and the bull market can move forward. Any signs of an economic slowdown or central banks raising interest rates could derail the bulls. In addition to the fundamentals, the market will be handicapping the elections, geopolitical events, market technical factors, the October effect and everything else rolling through the news cycle.

It’s been a good year to own financial assets. Periods of strong performance provides a great time to review your portfolio, reassess your risk tolerance and evaluate your emotional state. The fourth quarter could bring higher volatility. If it does, it is better to enter this period mentally strong, fully committed to both your portfolio and time horizon. Remember, financial success is measured in years, not weeks or months.

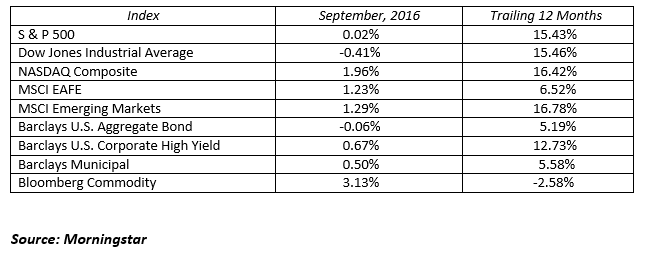

MARKETS BY THE NUMBERS:

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222