Third quarter earnings season will thankfully return investor focus back to market fundamentals. Corporate revenues and profits can sometimes get lost in the market noise, but they are the ultimate long-term drivers of stock prices and valuations. This quarter’s earnings results are especially important as they will set the stage for next year’s expectations and the start of a new decade.

The recent news cycle has hijacked market attention away from the fundamentals to the breaking news of the hour. The trade wars and tariffs are a great example. For almost two years, the ebb and flow of investors’ moods seem to rise and fall with each U.S. and China trade headline. One day this month, stock prices declined sharply on escalated trade tensions as the White House bans 28 Chinese companies from doing business in the U.S. Later in the same day, the U.S. issues travel bans on selected Chinese officials. Three days later we are told of a “very substantial phase one deal” with China. In the following week, China appears to walk back the idea of a trade deal. Stay tuned.

If U.S. and China trade tensions weren’t enough, let’s add concerns of a global recession, impeachment proceedings, and a string of disappointing initial public offerings (IPOs). The market has also been focused on the Federal Reserve drama, the potential of an inverted yield curve, Brexit, and the political rhetoric building for the 2020 election. With so many distractions, it’s easy to lose sight of market fundamentals – earnings and valuations.

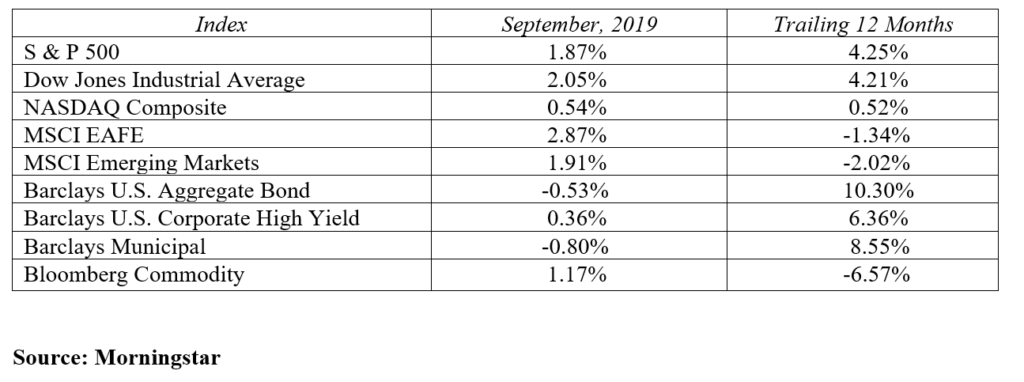

There are just two months left in the year and it has proven to be a terrific year for the financial markets so far. On a year to date basis through October, the S&P 500 is up 23.2%, the NASDAQ Composite is up 26.0%, and international stocks are measured by EAFE are up 16.9%. The S&P 500 achieved its fourteenth and fifteenth all-time high this year in October. Even the U.S. Aggregate Bond Index has gained 8.9% so far this year at a time where most were convinced interest rates were poised to move higher, pushing values lower.

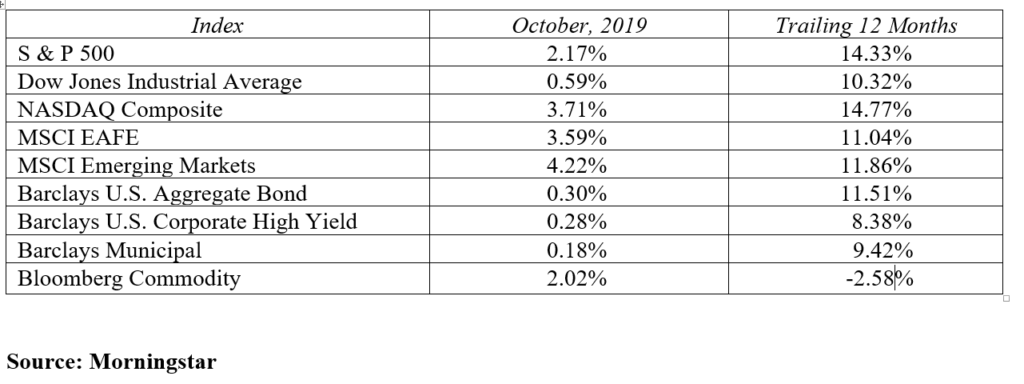

Overall, the news on third quarter corporate earnings has provided a welcome tailwind to the stock market. Over 70% of the companies which reported earnings to date have exceeded analyst expectations. Those companies with positive earnings like Apple, Netflix, Morgan Stanley, J&J, JP Morgan, Pfizer, Tesla, and Merck all saw significant jumps in their share prices. The companies with disappointing results were punished by the market. Those included Amazon, IBM, Twitter, Grub Hub, and Beyond Meat. The net effect for October was market gains across the global indices. In the U.S., the S&P 500 gained 2.2%, the Dow Jones Industrial Average added 0.6% and the NASDAQ rose by 3.7% in October. International stocks also rallied as the EAFE and Emerging Markets were up 3.6% and 4.2% respectively.

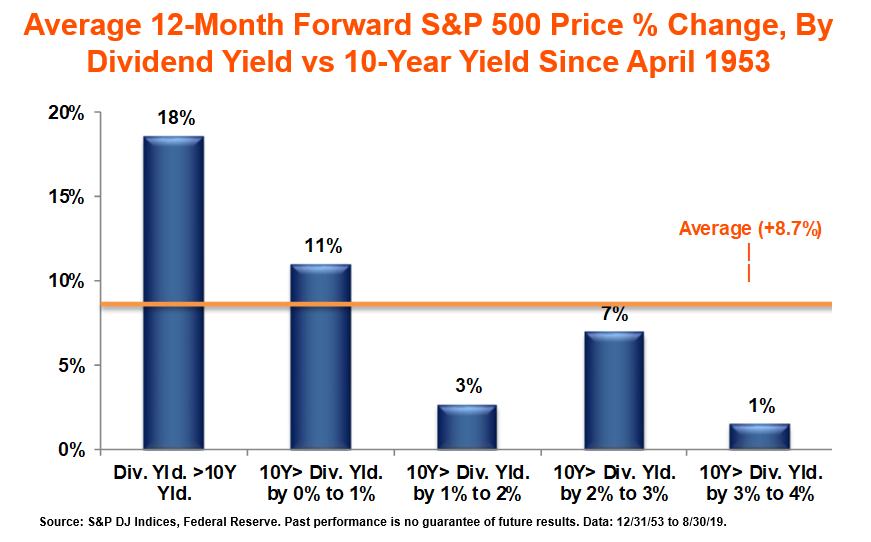

After a period of free falling interest rates, rates reversed course in October sending yields back to mid-September levels. However, that level was still well below the mid-January peak in yields this year. The Federal Reserve delivered on market expectations by lowering the fed funds rate by 25 basis points for the third time this year. The fed funds target now stands at 1.5% – 1.75%. The Fed sighted a slowing global economy, trade concerns and low inflation as the main points for allowing this third rate cut. The summer fear of an inverted yield curve is clearly in the rear view mirror as the 2-year U.S. Treasury Note is now yielding 1.52%, which is 17 basis points less than the 10-year U.S. Treasury Note.

News on the economy continues to support the markets. Third quarter GDP growth in the U.S. economy decelerated much less than anticipated coming in at 1.9% versus the 1.6% expected and the 2.0% growth achieved in the second quarter. The University of Michigan’s Consumer Sentiment Index rose to 95.5 after spending the prior two months in a range of 89.8 to 93.2. Strong consumer confidence heading into the all-important holiday season is good news for the economy. The Department of Labor said that employers added 136,000 net new workers in September. Unemployment was at 3.5%, a level last seen in December 1969. The U-6 jobless rate, which counts both the unemployed and underemployed, fell to a 19-year low of 6.9%. October employment numbers released on November 1, 2019 showed continued strength with 128,000 jobs created and a 3.6% unemployment rate.

On the flip side, the Manufacturing Purchasing Manager Index fell to 47.8 in September, its lowest level in ten years. Investors worried that the number reflected weakening business confidence. ISM’s latest Non-Manufacturing PMI also declined, but the 52.6 reading indicated growth in the service sector last month. Shoppers scaled back their purchases in September. The Census Bureau announced a 0.3% dip for retail sales, the first decrease in seven months.

As 2019 winds down and we set our sights on 2020, it’s important to bring the right mindset with you on this investment journey. Challenge yourself to evaluate your personal perspective and dare to incorporate the following into your conscience.

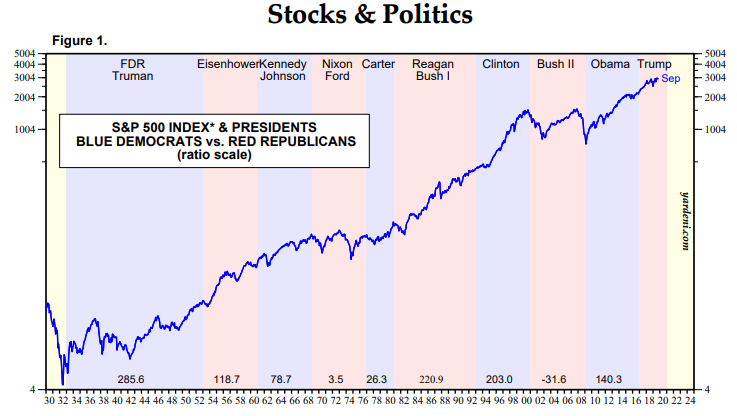

- Separate your political views from your economic views – with the 2020 national election looming, evaluate the economy on economic factors, not political factors

- Expect the market to advance and decline – the markets are never a smooth ride on a day to day basis, but historically the markets do go up over time

- Don’t let volatility alter your financial plan – the latest breaking news will have temporary market implications, but don’t let emotions affect your plan

- View the glass as half full versus half empty – practice long-term trust and optimism and avoid becoming an eternal pessimist

- Take a long term view – don’t let news of the hour turn your financial plan into a market timing scheme.

Stay your financial course as the future is likely brighter than you give it credit.

MARKETS BY THE NUMBERS:

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222