The stock market has had an increase in the level of volatility over the past several months. Generally, more volatile markets can have a negative impact on the psyche of investors because of the perceived possibility of greater loss. The reality is there are always fluctuations in the stock market and bursts of volatility are quite common. Our stance is that, while volatility and uncertainty can create higher concern in the short term, investment opportunities are created by volatility that can pay off handsomely in the future.

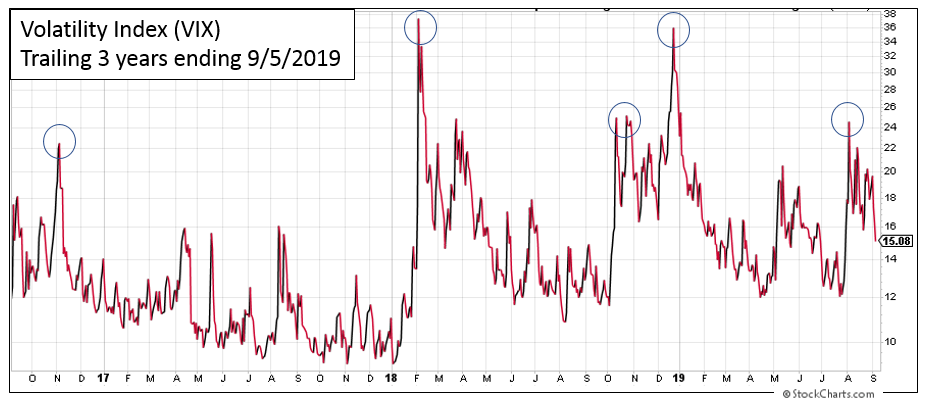

A common measurement of stock market volatility is the CBOE Volatility index (VIX). The VIX is a measure of expected price fluctuations in the S&P 500 Index options over the next 30 days. It provides a measure of market risk and investors sentiment; some refer to it as a fear index. As seen in the chart below, the VIX has had several spikes in volatility over the last few years.

Even though the stock market has had periodic bouts of volatility over the last three years, the S&P 500 was still up over 44% during this period1, despite the volatility.

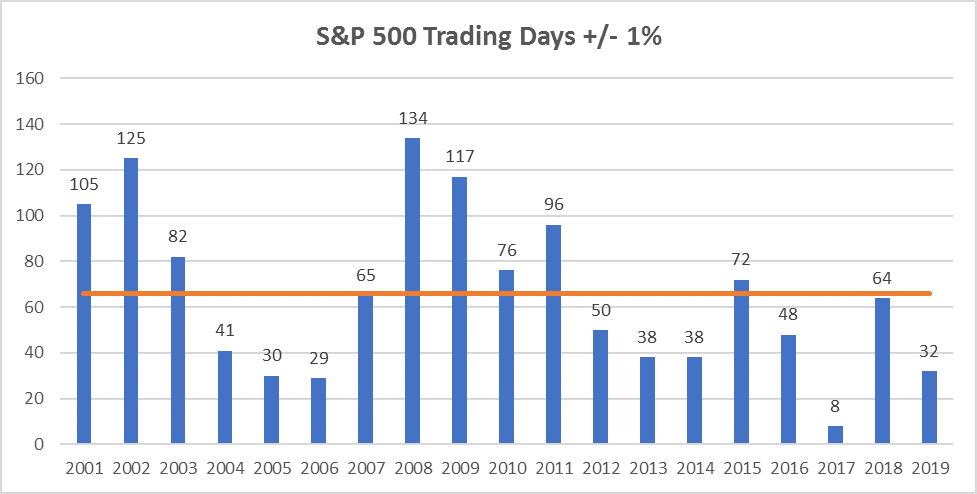

Another measure of volatility is the number of days of a plus/minus 1% change in the S&P 500. In 2019, there have been 32 days of plus or minus 1% moves, with 13 coming in the last month alone. Putting that in perspective, the average move of more than 1% has been 66 days per year for the last 19 years (see the chart below).

Further, the chart reflects only one year in the last seven that has been above the 19-year average. This shows that while volatility has picked up recently, this isn’t out of the historical norm and, in fact, has been less volatile compared to other periods.

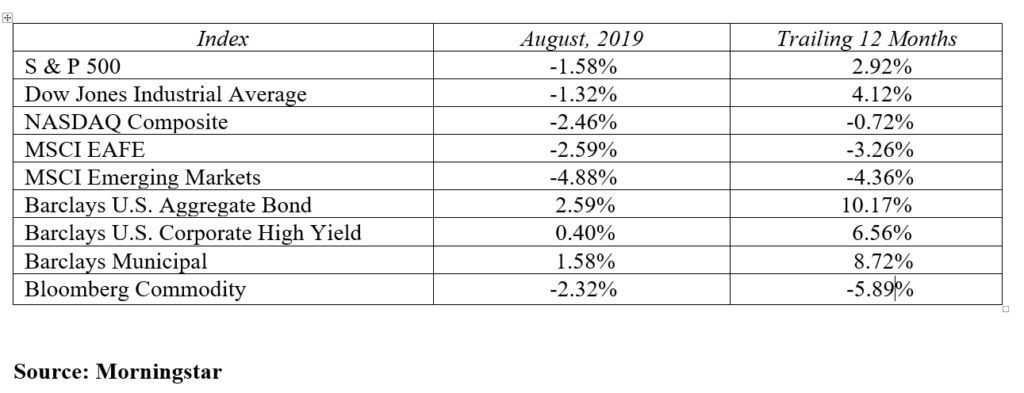

There are several reasons why market volatility has picked up in the recent months, including

- Global economic data been slowing

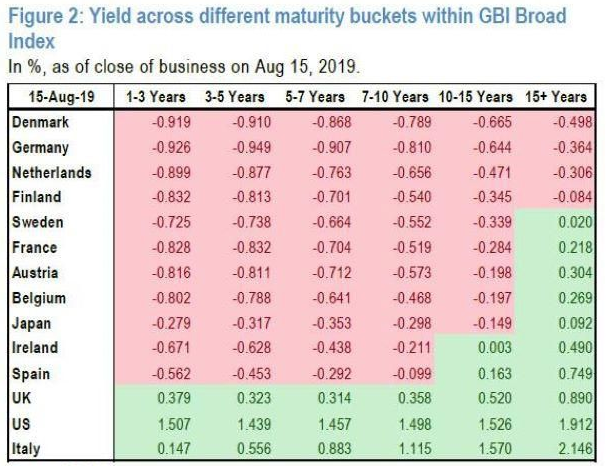

- Global interest rates have been compressing

- Increased trade tension between the US and China

The reasons for volatility are real, but the one constant of the market is there are always issues to worry about whether it is the economy, Federal Reserve policies, elections, oil prices or the health of the consumer.

While volatility certainly brings anxiety, it is not necessarily always a negative occurrence. Volatility can be positive and refer to times when stocks are moving up quickly. Most investors are more concerned with downside volatility but even that can create long term opportunity for investors who are prepared to take advantage of these situations through dollar cost averaging.

As we stated prior, volatility is common in the markets, and timing these instances is extremely difficult. For investors interested in reducing overall volatility for their investments, we have recently launched the “Gradient Buffered Index Portfolio”. This portfolio offers a pre-determined level of downside protection, allows investors to participate in market upside (to a cap level) and has a short-term maturity. If you have interest in this type of strategy, please feel free to reach out to Gradient Investments for more information.

To expand on these Market Reflections or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222.