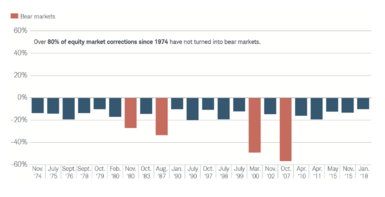

The final quarter of 2018 had the feel of the highly volatile first quarter. The year began with enthusiasm as lower taxes sent stocks to all-time highs. This euphoria quickly subsided and morphed into a rapid 10% price correction. Entering the fourth quarter, major U.S. stock market indices had reached new all-time record highs, only to finish the year with another round of gut-wrenching declines. This time the correction reduced S&P 500 values by 13.5% for the quarter and ended down 4.38% for the year.

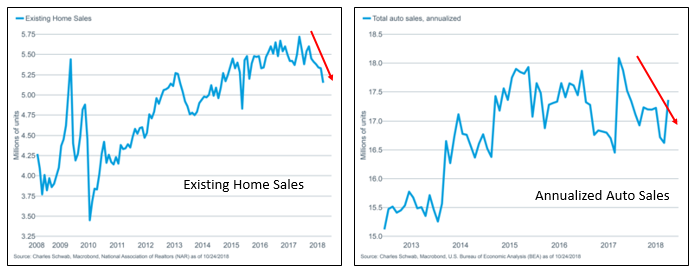

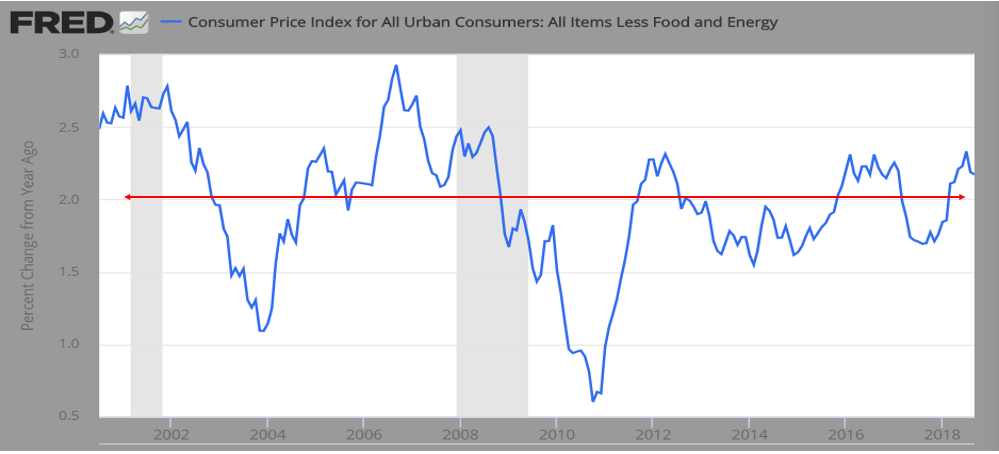

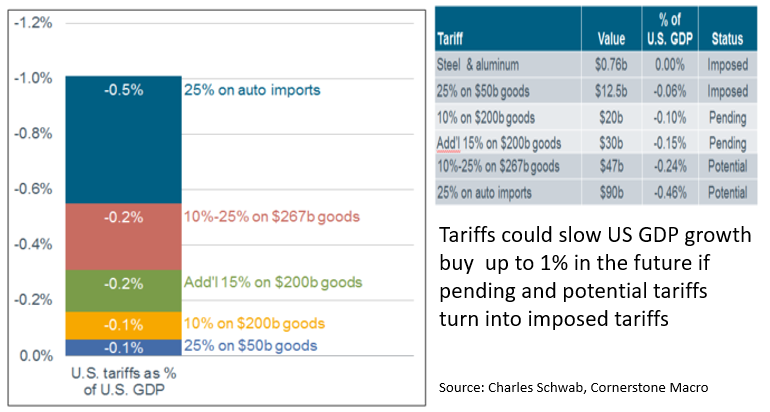

The fourth quarter left a mark on both client assets and their psyche. Wild price swings are uncomfortable even for the most seasoned investors. Heightened volatility came from many sources. This time the list included higher short-term interest rates, the Federal Reserve’s tightening monetary policies and hawkish comments, potential for an inverted yield curve, trade tensions between the U.S. and China, a government shutdown, slower global economic growth, falling oil prices, politics and simple old-fashioned fear. Through time, the market cycles from rising prices to price corrections that eventually pave the way for future upside potential. The pathway to a better 2019 will be built on a foundation of strong economic fundamentals. Consumer confidence remains high, unemployment is low at 3.7%, corporate earnings are expected to grow 8-10% next year, and GDP growth is expected to be in the 2.0-2.5% range with low inflation.

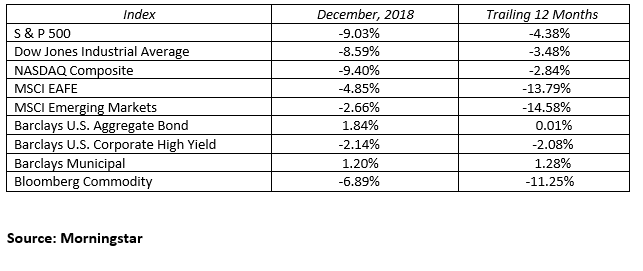

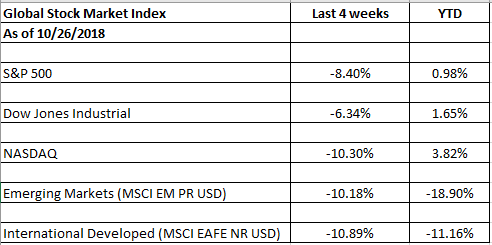

Solid economic fundamentals did not deter this quarter’s painful price correction. Stocks largely went into freefall from highs set in September. The major indices experienced fear-inducing declines. The NASDAQ Composite, S&P 500 and the Dow Jones Industrial Average lost 17.3%, 13.5%, and 11.3% respectively in the fourth quarter. International stocks also struggled as the MSCI EAFE and emerging markets indices produced losses of 12.5% and 7.5% for the quarter. The high flying “FAANG” stocks that carried the markets to new highs over the past nine years were hit hard. Amazon, Apple, Alphabet (Google), Facebook, and Netflix experienced quarterly declines between 13.4% and 30.6%.

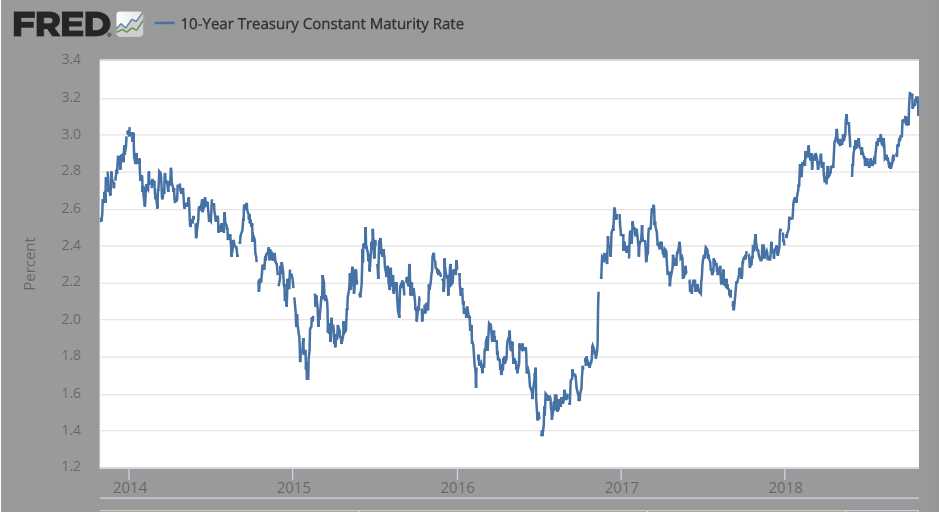

When stocks fall, bonds usually provide some portfolio relief. Thankfully, investment grade and treasury bonds did that in the quarter. Despite a fourth 25 basis point rate hike to the fed funds rate this year, the Bloomberg Barclays Aggregate bond index managed a positive 1.6% return for the quarter. Unfortunately, high yield bonds suffered along with stocks, declining 4.5% in the fourth quarter. The benchmark 10-Year U.S. Treasury fell below 3% yield in the fourth quarter, declining by 36 basis points to end the year yielding 2.69%. The yield curve flattened on the short end and steepened on the long end as the 2-Year Treasury fell by 33 basis points to end the quarter yielding 2.48%. Meanwhile, the 30-Year Treasury fell 17 basis points to yield 3.02%. The yield curve showed its first signs of inversion as the 2-5 year segment of the curve temporarily inverted, but for now the overall curve remains positively sloped.

We consistently preach the necessity to remain focused on your long-term financial goals. A violent correction, like the one just experienced, creates fear. If left unchecked, fear will cause well-intended long-term investors to sell low and buy back at higher prices. It takes courage and commitment, but it is important to avoid this very-common investor pitfall. Hopefully, your financial plan has been carefully constructed with your long-term goals and risk tolerance levels in mind. Staying the course in the face of fear is challenging but necessary to achieve your long-term objectives. The pain here is real, but time will eventually heal these wounds. Starting 2019 after a fairly significant correction in 2018 energizes our outlook for the New Year, as we forecast generally stable interest rates and mid-to-high single digit stock returns.

MARKETS BY THE NUMBERS:

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222