by Jeremy Bryan, CFA

Stocks are firmly in positive territory after a difficult 2022. Despite the positive performance, questions regarding economic growth, inflation trends, and Federal Reserve actions have many investors wondering if this recent rally is a mirage. The beginnings of bull market rallies are often met with a healthy dose of skepticism and fear of the next shoe to drop. However, bull market rallies often exceed even positive prognostications and those that remain paralyzed to the fear of a reversion can often get left waiting for a doomsday scenario that never arrives.

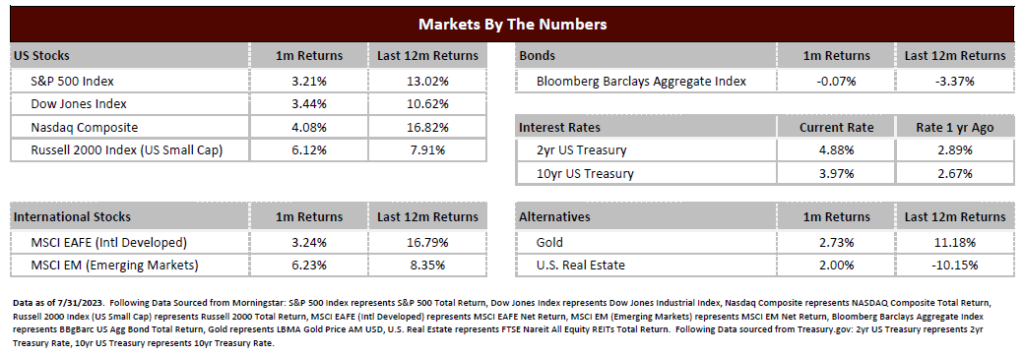

Economic sentiment in 2023 has been characterized as the “just around the corner” recession, which has been widely predicted but yet to materialize. There are certainly historical precedents to suggest this viewpoint is warranted. First, the actions of the Federal Reserve to control inflation, mainly by increasing interest rates, usually lead to a slowing economy that often overcorrects into recession. Second, the treasury yield curve has been inverted (meaning short maturity treasuries have higher yield than long maturity treasuries) for over a year now, and inverted yield curves have historically preceded future recessions.

Contradicting this outlook is the continued growth in US Gross Domestic Product (GDP). The first and second GDP results were in positive territory and recent estimates are reflecting an accelerating growth profile. Also, corporate earnings estimates for the S&P 500 have stabilized and reflect flat growth in 2023 but with potential for double digit growth in 2024.

The primary reason, in our estimation, for continued US economic growth has been the resilience of the US consumer combined with a renaissance in US manufacturing. For the consumer, jobs demand remains high, and wages are growing. This has led to continued spending even as spending trends shifted from goods to services. Lastly, after a long period of stagnation, the US is experiencing high growth in manufacturing, especially semiconductor manufacturing. This has come from businesses “onshoring” their supply chains as insurance against future potential disruption, and from incentives created by fiscal policy via the inflation reduction and CHIPS acts.

Our opinion is that a “soft landing”, or a slow growth environment avoiding recession, is now the more likely scenario. However, this is still a manner of degrees of confidence and nowhere near a certainty. Job loss and corporate earnings declines tend to come as we fall into recession, so they are not great predictors of recessions. The further the Federal Reserve pushes interest rates higher to control inflation, the greater the potential for a future recession. If the economy begins facing greater than expected job loss, the resulting conservatism of spending could lead us to recession as well. We don’t believe these are the most likely scenarios, but they certainly are possible.

Despite a higher degree of confidence that we can avoid recession, this doesn’t mean the market is immune to correction. Five to ten percent declines happen all the time, even in a healthy bull market. These corrections are a part of investing as markets rarely go straight up over an extended period. There are fits and starts in all bull markets, and we fully expect higher volatility and a correction to arrive at some point in the future.

Finally, remember that there are diversified ways to achieve returns in the current environment. Interest rates are significantly higher than they were two years ago. This is a negative for spenders but is typically a positive for savers. Savers now achieve higher rates of return for the same amount of risk. This is a good outcome and allows investors to strike the right balance of growth and safety but still meet their long-term investment objectives. Given the significant performance of the stock market year to date, it may make sense to understand your current risk profile and adjust allocations back to the proper alignment. This is very different than timing the market, which we do not advocate, but rather a rebalance back to the proper asset allocation.

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222.