The market is rallied on Monday after the Trump administration announced that the “trade war” with China is on hold. This is good news as investors were alarmed at the prospect of a global trade war. Now that the US and China have put additional tariffs on hold, the market may begin to focus on another metric to worry about, that’s inflation.

Inflation can hurt both consumers and corporations as it increases their costs. If inflation gets too high it tends to crimp economic growth, curtail consumer spending and raise input costs for businesses. None of these things would be looked at favorably by investors. The market hasn’t had to worry about inflation for quite some time, but recently several factors have emerged to raise inflation anxiety levels. They are:

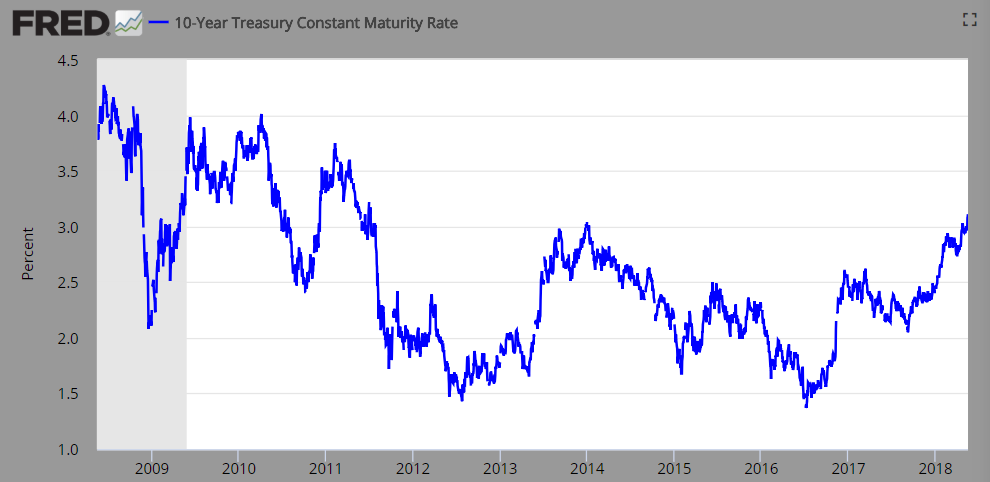

- Interest rates are rising. The 10-year Treasury yield currently sits at 3.06%, a four year high

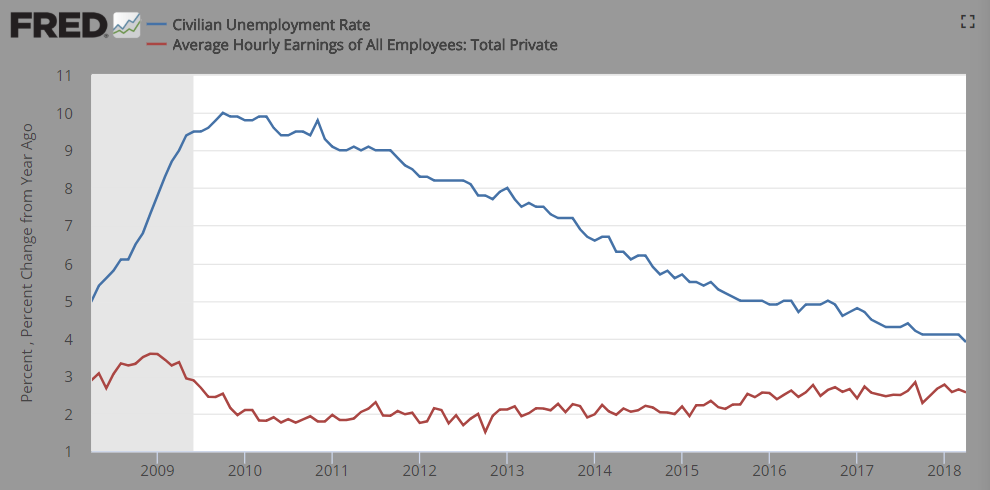

- The unemployment rate has fallen below 4.0%, sparking fears of wage inflation

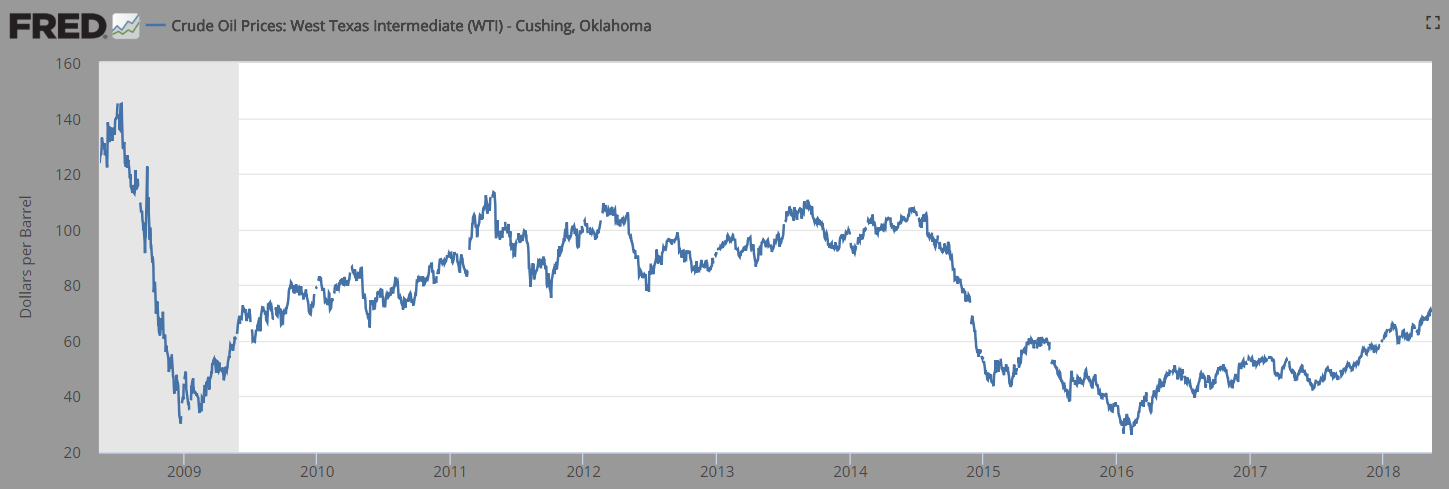

- The price of oil has risen over the $70 per barrel level, raising concerns about energy costs

Let’s look at each in the charts below.

First look at the 10-year Treasury yield below as it’s moving towards post-recession highs:

Next, let’s examine the unemployment rate and wage inflation. The unemployment rate (blue line) is at ten year lows, while wage growth (red line) is gradually rising:

Finally, energy is a big cost for both businesses and individuals. The price of oil has rallied substantially lately to 3½ year highs, but still below the critical $100 per barrel level:

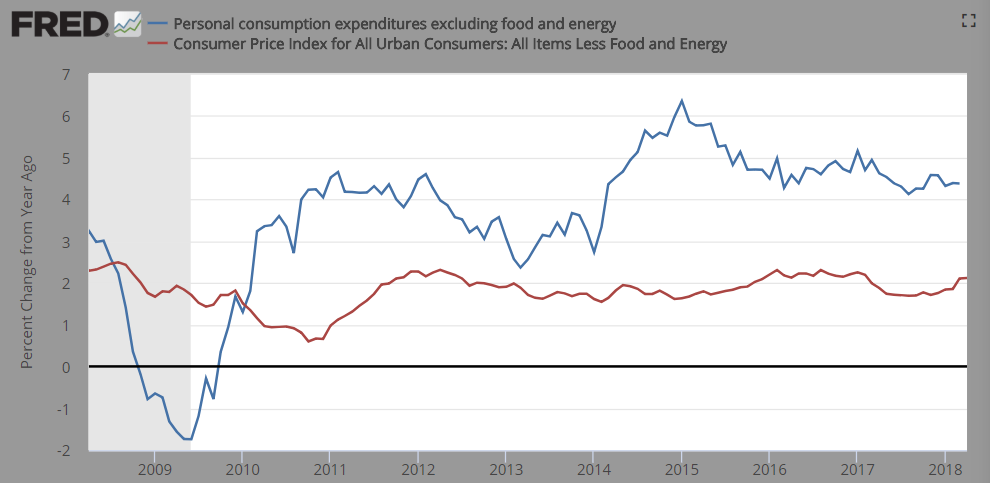

The combination of the above has led investors to become mindful of the risks higher inflation can have on the markets. But remember that the Federal Reserve believes that a certain level of inflation (roughly 2.5%) is good for a healthy economy. Inflation is measured by the Department of Labor in several different ways. The most common measures are:

- The consumer price index (CPI) which measures the prices consumers pay for frequently purchased items

- The personal consumption expenditures index (PCE) which measures a more comprehensive list of consumer items

- The producer price index (PPI) which measures prices from a seller’s point of view

The PCE index is the preferred measure by the Fed as it analyzes inflation and makes interest rate decisions. It also prefers to use the “core PCE” index to analyze underlying inflation trends, which strips out food and energy components which tend to be very volatile. Investors watch both core CPI (red line) and core PCE (blue line) indices.

Looking at the chart above, both inflation readings are not yet at alarming levels. The core CPI (red line) index is above 2.0%, but still below the target of 2.5%. The core PCE index is relatively stable since coming off its highs in 2015.

In summary, inflation seems to be contained and within normal levels within an expanding economy. Recently, the tightening of the labor market, rising wages and increasing energy costs could potentially lead to future increases in inflation readings. These metrics bear close monitoring, and we’ll be watching to see if our stance on inflation needs to change.

To expand on these Market Reflections or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222.