Those are always comforting words when flying. The pilot will usually follow up with a comment about turning off the seatbelt light and telling passengers they are free to move about the cabin. There is usually a safety recommendation to keep the seatbelt fastened while seated. In the stock and bond markets it feels like we have reached our cruising altitude, but we advise that you keep your seatbelts fastened in case we hit some unexpected turbulence.

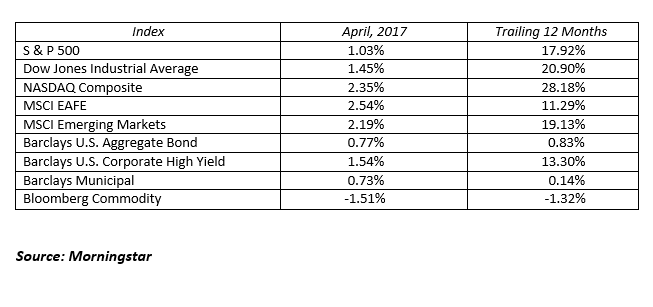

In April, the stock market leveled off at a comfortable altitude. A French preliminary election and a new round of quarterly corporate earnings brought us back to the 21,000 level on the Dow Jones Industrial Average. All the noise regarding Syria, North Korea, trade wars, walls, immigration, tax cuts, Obamacare, and shutting down the federal government can be a distraction to what really matters: corporate earnings. Thankfully, the market has not lost its focus. Strong earnings from McDonald’s, Alcoa, Caterpillar, and DuPont were welcome news and signaled that another quarter of solid earnings is on the way. The technology sector fueled the Nasdaq Composite to breach the 6,000 milestone with Facebook, Netflix and Google (now Alphabet) reaching records highs. International stocks are back in play as the news from France ignited a rally overseas. At the end of the month, it was the international developed stock group taking home the first place trophy with a return of 2.54% followed closely by the NASDAQ Composite and emerging market stocks with monthly returns of 2.35% and 2.19%, respectively.

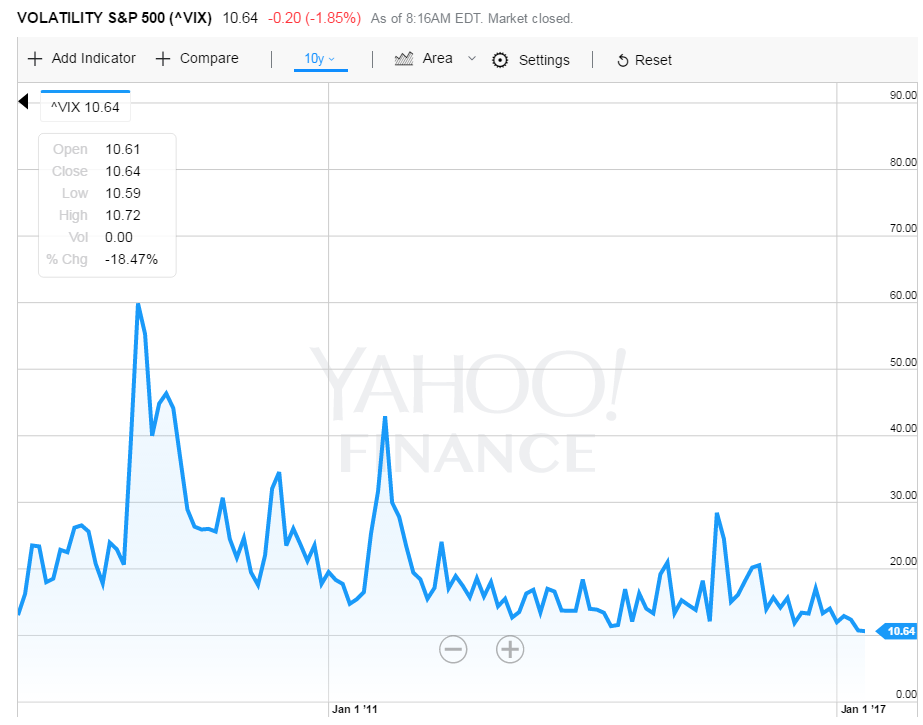

Since our elections last fall, the market has moved steadily higher with volatility nearing record lows. This is not uncommon as a smooth ride keeps investors comfortable. This feeling of calm will not last forever, but take the time to enjoy it. Graphically, this 10-year chart of volatility speaks volumes about the underlying positive tone in the market:

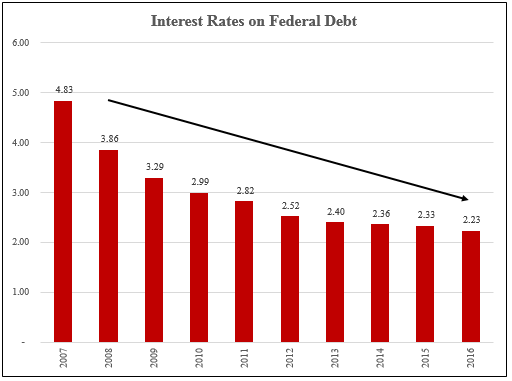

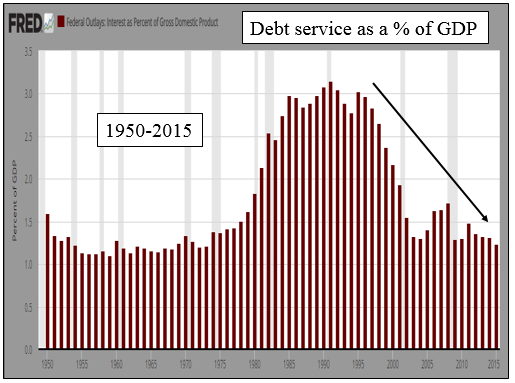

The bond market continues to befuddle experts as interest rates appear to have a mind of their own. The 10-year U.S. Treasury Note traded in a range of 2.4% to 2.2% during April and finished the month yielding 2.3%. There are some interesting dynamics at work in both the U.S. and international bonds markets. Interest rates throughout the developed world are low and continue to remain low. In the U.S., we tend to compare the yield of the 10-year U.S. Treasury Note to where it’s been over the past 10-15 years, and we can accurately state that our interest rates are low. When you take the next step and compare our 2.3% yield on 10-year to Germany at 0.3% or France at 0.8% or Japan at 0.0%, you begin to realize our interest rates are quite attractive in a global sense. While the consensus is for higher interest rates in the U.S., getting there will be slowed by global factors destined to keep interest rates low.

Stay positive with your investment program and enjoy the ride. Asset prices will correct at some point in the future, but for the present time we are in a sweet spot of positive corporate earnings, low interest rates and low volatility.

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222