The election is over and democracy lives. It was fascinating to monitor the stock and bond markets in the days just before and after the election. In the two days leading up to the election, the pollsters and media had everyone convinced the outcome was known. The markets were comfortably braced for more of the same. The stock market rallied strong on Monday and again on Election Day. In the twenty fourth hour on Election Day, it became apparent voters had a different plan as Donald Trump was on the verge of becoming President-elect Trump. Immediately headlines began streaming: Dow futures down 300, Dow futures down 500, Dow futures down 800, five percent limit down on the S&P 500 futures. My final thought of the evening was, “Tomorrow will be a great buying opportunity.”

When the next day arrived, so did some rational thinking. In the pre-market, futures were down just 1.5 percent versus the five percent limit down from the previous night. By the time U.S. stocks opened for business, they quickly rallied back to flat and proceeded to close up 1.5 percent on the day. When the week ended it was the best week for stocks in the past five years. The three major stock market indices went on to post three new highs for the year.

On November 29 the OPEC members agreed to a 1.2 million barrel per day oil production cut in a resolve to boost prices. Although it was a widely anticipated event, doubts of a significant agreement had been gathering in the days and weeks leading up to the meeting. Oil prices rose 9.5 percent on the announcement to nearly $50 per barrel, and the energy sector as a whole rose significantly.

There are a few key points to take away from these experiences. Remember that it’s “time in the market” versus “timing the market” which makes all the difference. You should always be invested (at the right risk level) and especially during strong markets that are sometimes unexpected. We are true believers that your political views should not influence your investment plan; this rang true in November. Politics are personal and based on your beliefs and values, while your investments need to be rooted in market fundamentals.

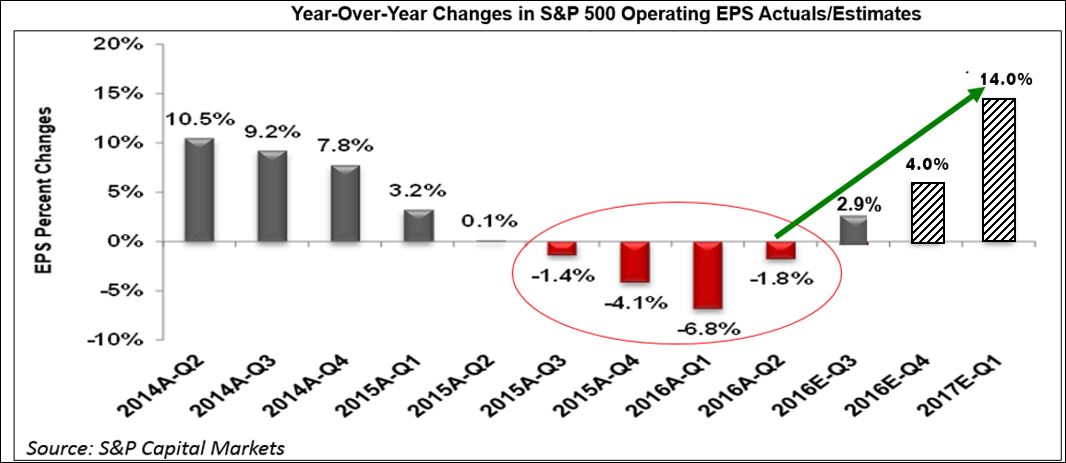

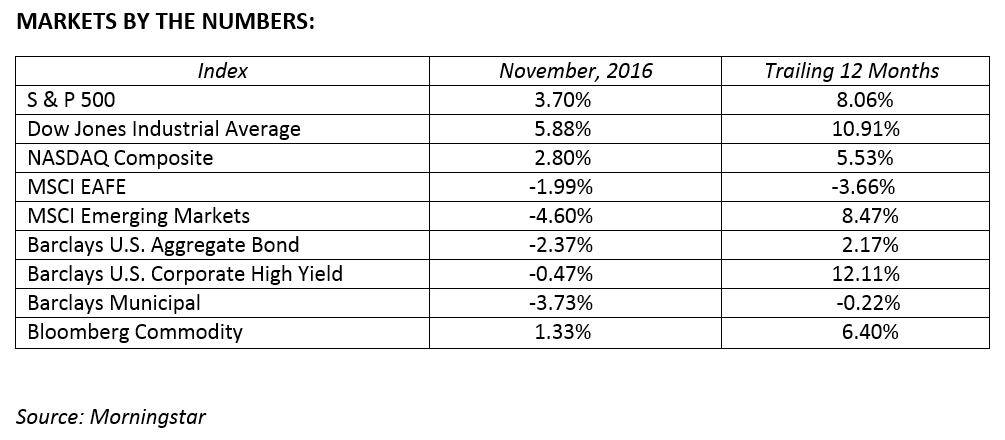

The S&P 500 had a very strong month, up 3.70 percent to close at 2198.81. Likewise, the Dow Jones Industrial Average and the Russel 2000 reached new records in November. The stock market was led by financials and energy. International stocks did not fare as well as future U.S. trade policies are a bit uncertain. Emerging markets posted a 4.60 percent drop while developed international stocks declined 1.99 percent in November. Corporate earnings season is in full swing and the results have shown a much-awaited turnaround, albeit small. Earnings are beginning to grow again!

In December we will focus on analyzing what went well this year and what we can look to enhance as we enter 2017 under a new administration. Despite all the noise and headlines, we expect 2017 to be a good year for stocks as strong consumers and growing corporate profits could drive prices higher. The fundamental key will be corporate profits. If the earnings growth estimates in the graph below become reality this will likely support the stock market throughout 2017.

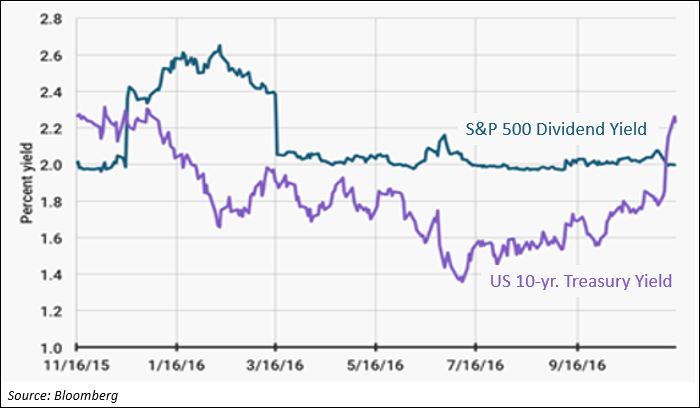

The bond market is entering a new phase, rates have risen in the past few weeks and in the short term have hurt bond prices. Janet Yellen’s term will expire in February 2018, and the Fed could become more hawkish under new leadership. For now, we believe a 25 basis point hike in interest rates during the mid-December Federal Reserve meeting is a done deal.

Looking ahead, we expect the Fed Funds rate to settle in the 1.00 to 1.50 percent range by the end of 2017. Rates will remain low by historical standards, but the 10-year U.S. Treasury Note may produce yields north of 2.50 percent next year versus the 1.75 percent experienced this year.

Voters chose a new political course. You chose your investment course. Our best advice is: “Don’t let the political changes change your investment program.” We are pleased with the portfolio results thus far in 2016. Stay committed and maintain a diversified portfolio designed with your risk tolerance in mind. Time will bring you to your financial destination if you let it work for you.

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222