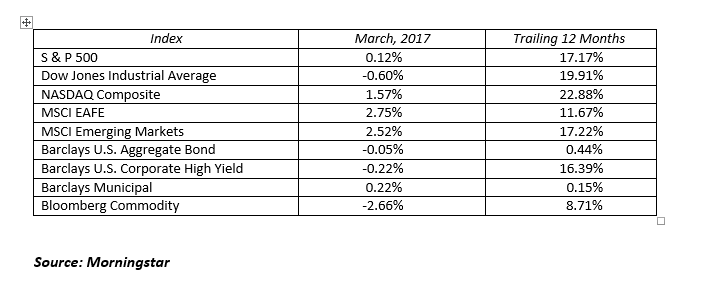

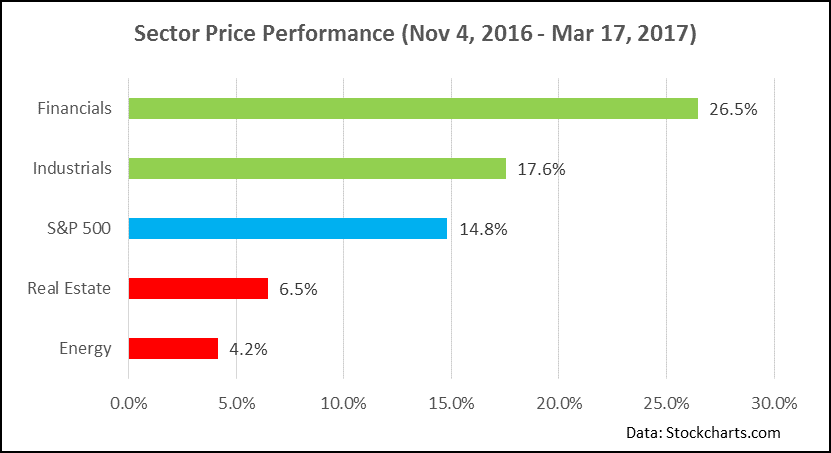

If you like action, the first quarter was fast and furious. The stock market continued to find new highs on a daily basis with the Dow Jones Industrial Average surpassing 20,000 for the first time. Before the market caught its breath, the 21,000 level was shattered in just 24 trading days. Some of the air was let out of the balloon in March as the Federal Reserve raised the federal funds rate by 25 basis points and healthcare reform died in Congress, clouding the picture for future tax cuts.

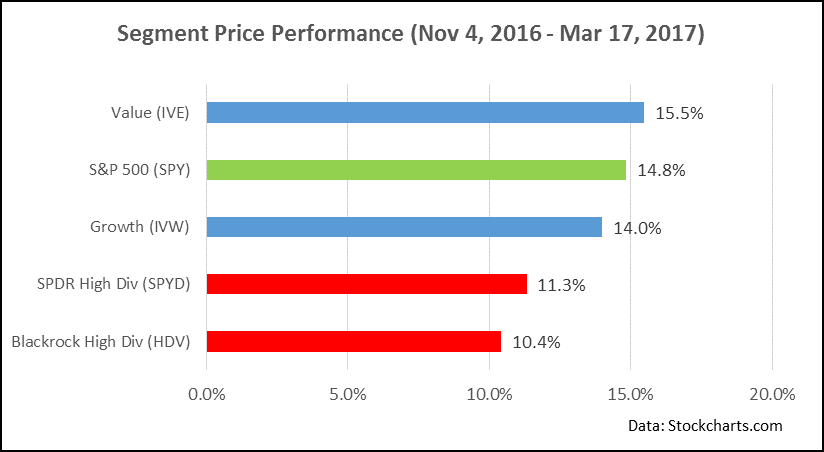

The U.S. stock market has responded positively to a pro-business agenda emanating from the new leadership in Washington. With the backdrop of a growing economy, full employment, expanding wages, low inflation and a confident consumer, the promise of less regulation and lower taxes has fueled this market. While this formula brought us here, the question becomes, “Can the concepts be converted into policies and reality?” Stay tuned.

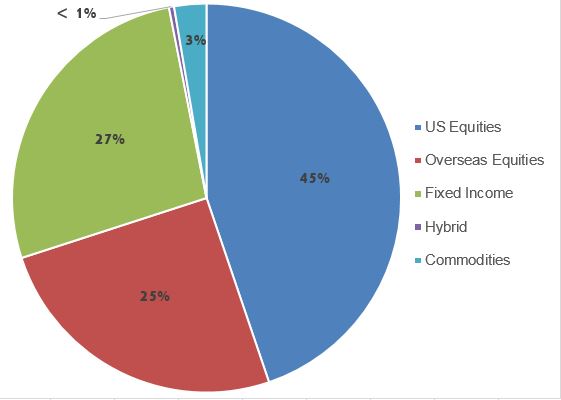

Stock returns were positive around the globe last quarter with emerging markets and international developed leading the way. International markets are becoming more attractive after under-performing the U.S. over the last 1, 3, 5 and 10 year periods. A recent acceleration in overseas economic growth is becoming reflected in their stock prices. The U.S. market found leadership in our old FANG (Facebook, Amazon, Netflix and Google) names and added another A for good measure (Apple). This group of stocks had an average return nearing 20% in just the first quarter. Energy was the primary laggard as oil prices found their way to just below $50 per barrel, down from a high of $56 in mid-February.

This is an interesting time for the bond market. The Federal Reserve is on a long overdue mission to raise short-term interest rates and return to a normal monetary policy. This will likely be the first year in the past ten where the Fed raises rates on multiple occasions. In addition to two or three more rate hikes this year, the Fed also must reduce their balance sheet by selling trillions of bonds they purchased during the multiple quantitative easing programs. This process will take years to unwind. We expect that interest rates will move higher at a glacial pace with the Fed deliberate and the economy stable.

Bonds traded in a tight range for the quarter with the 10-year U.S. Treasury reaching a peak yield of 2.62% and bottoming out at 2.31%. It closed the quarter yielding 2.40%, five basis points lower than where it began the quarter. Credit spreads also tightened a bit providing an incremental lift to bond prices this quarter. Investment grade spreads were 5 basis point tighter and high yield rallied 29 basis points, helping this sector outperform. It’s okay to own bonds for the basic reasons of income, principal preservation or volatility control, but temper your expectations for this asset class as we move through the year.

It is important to remember that markets move higher over time, but they do not move higher all the time. The first quarter was a solid one despite a slight pullback in March. We believe the markets are fairly valued here, but not overvalued. Stocks moving 5% higher from here by year end and bonds earning the coupon are reasonable 2017 expectations. Like 2016, there will be some bumps in the road. An employed and confident consumer in a lower tax world will lead the way to moderately higher stock prices. Stay invested and use any pullbacks as a buying opportunity.