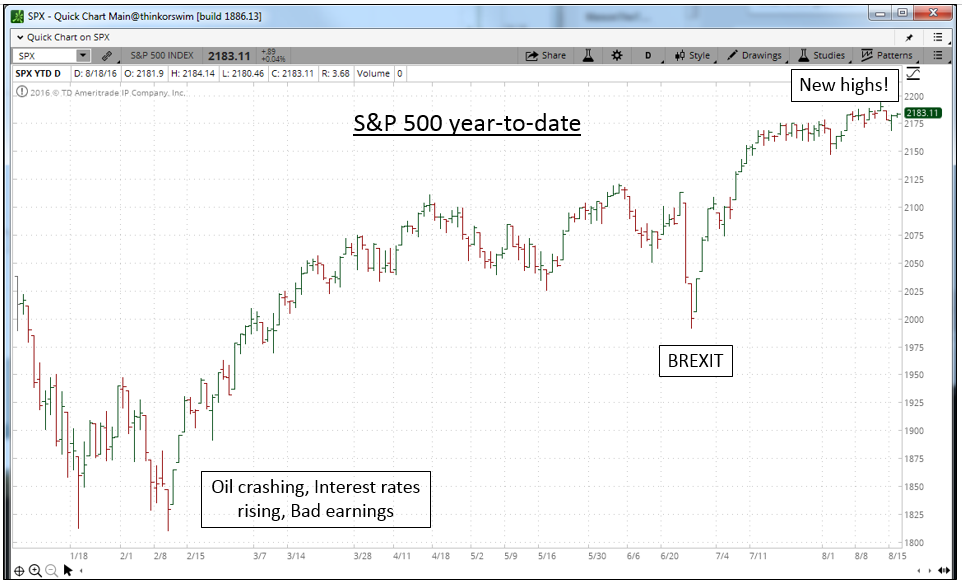

2016 has been an interesting year in global stock markets. Volatility has increased, but so has performance returns in most global markets. The volatility was anticipated as many investors and strategists were somewhat pessimistic coming into the year. Their reasons were several:

- Oil prices were crashing

- The Fed was looking to normalize (raise) interest rates

- Corporate earnings were forecast to decline on a year over year basis

- Market valuations were above their 10 year averages

- China’s economic slowdown and Europe’s economic malaise

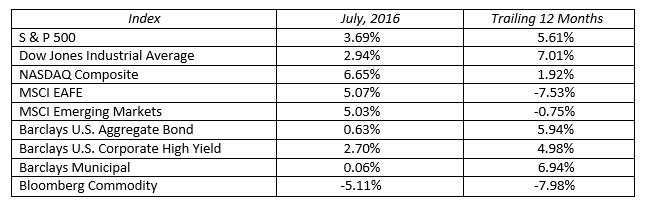

Our forecast that 2016 would provide positive returns in the U.S. markets, roughly mid-single digits (which means 4-6%). At the beginning of the year our forecast looked aggressive, but currently the S&P 500 is up about 8%, and dividend paying/blue chip stocks have performed even better. 2016 has surprised many investors and the stronger returns have left many institutional equity managers scrambling as they find themselves trailing the indices.

Despite the increased volatility, investor pessimism, and negative headlines U.S. stock markets are hitting all-time highs. What’s driving the strong returns? Well, even with amplified market volatility and minor market corrections:

- The global economy continues to show moderate and steady growth

- The Fed and other global central banks are keeping interest rates low

- Oil prices recovered

- BREXIT fears appear to be greatly over exaggerated

The bottom line is that there will always be noise in the markets, there will always be corrections too. A great example of this is the turbulence BREXIT caused. Right after the surprise BREXIT vote, global investors decided to sell first and analyze the situation second. This was a mistake. Often these situations can create opportunity, occasionally they are pertinent to the trajectory of market fundamentals. Our approach is to assess the situation, determine how it affects portfolio performance and, if needed, take action. Following this process the investment management team can determine if situations (like BREXIT) deem investment adjustments or not.

To expand on these Market Reflections or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222