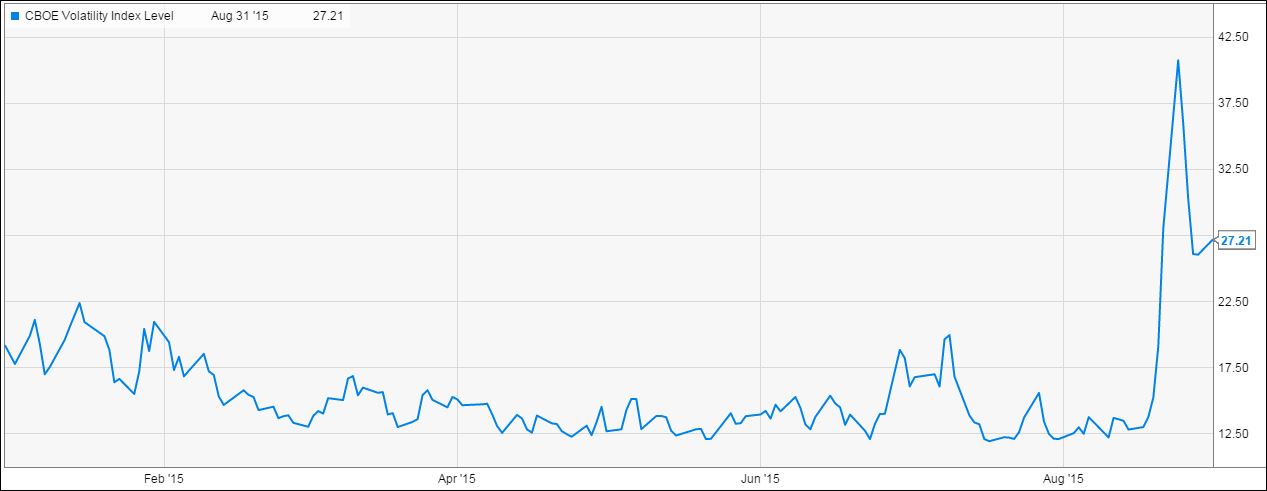

The third quarter was capped by a weak September which resulted in the worst quarterly stock performance in the last four years. After six years of positive annual returns a market correction was inevitable. While highly anticipated, the timing and the magnitude of a correction was unknown. The third quarter answered the timing question, although the jury is still out regarding the magnitude.

On the surface the market seemed irrational during this period of heightened volatility, but there were clear linkages between the cause and effect of economic events, policy decisions and market reactions. Let’s review what happened and suggest likely outcomes in the upcoming quarters.

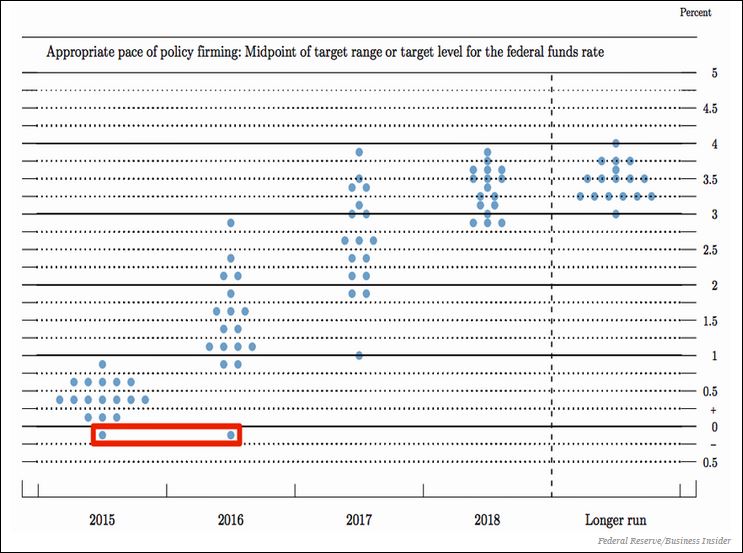

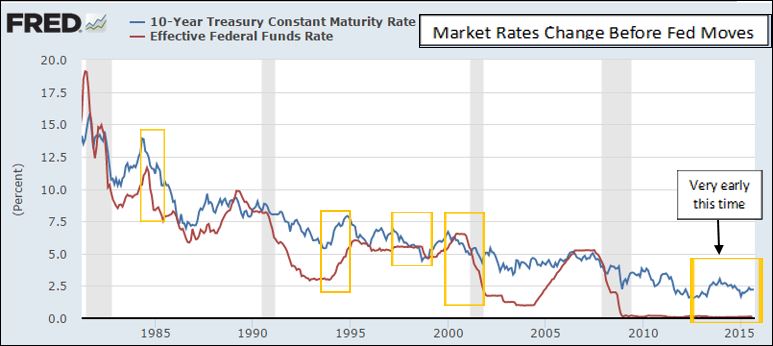

Multiple factors aligned to create pricing pressure on stocks, high yield bonds and commodities in the third quarter. Downward pressure on commodity prices led by oil’s second leg down raised concerns about emerging market economies and the energy sector itself. The economic slowdown in China caused wild stock market swings within their market and this spilled over to stock markets around the globe. Central banks here and abroad rushed to relieve any short-term pain. In Europe, a U.S. style quantitative earning program is underway. In China, they devalued their currency which is pegged to the dollar. In emerging markets, there has been an expansion of local debt. In the United States, the Federal Reserve Bank decided to maintain their zero interest rate policy. The market interpreted this as a no confidence statement from the Fed and stock prices immediately fell. Add some geopolitical risk and the correction recipe is complete.

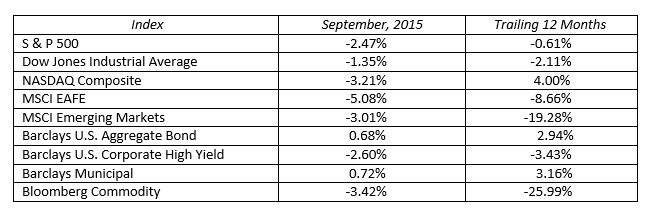

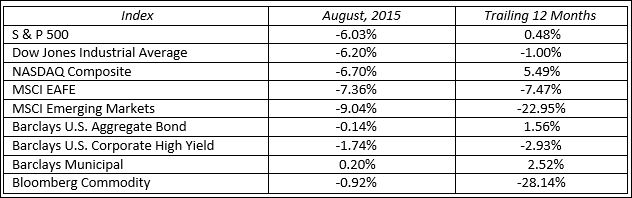

For the quarter, U.S. stocks continued to be the best horse in a weak field. The S&P 500 lost 6.44 percent, while the international markets were down 10.23 and 17.90 percent respectively, as measured by the MSCI EAFE and MSCI Emerging Markets indices. High yield bonds, which are highly correlated to the stock market, fell 4.86 percent during the period. This dragged both the year-to-date and trailing twelve month numbers into negative territory. Commodity price weakness continues to exasperate the markets, declining 14.47 percent in the quarter. The only bright spot was the investment grade bond market. The yield on the 10-year U.S. Treasury rallied back to the two percent level causing bond prices to rise. The Barclays Long-Term U.S. Treasury index was the best place to be this quarter with a 5.08 percent total return.

The message here is to hold diversified portfolios. As we begin to look toward the fourth quarter and into next year, we see stocks recovering and bonds maintaining value in a low interest rate world. The 2015 stock market struggles are functions of lower oil prices, a strong dollar, weaker than expected earnings, and slow economic growth. The commodity and dollar headwinds will turn into tailwinds in 2016 as values stabilize and earnings improve.

Volatile markets always test investor resolve. It has been smooth sailing for the past few years, and the third quarter was a rude wake up call. Successful investors have clear goals and objectives and the ability to remain focused on their long-term goals. This difficult quarter is setting the stage for a better 2016. Chart your course, stay your course.

MARKET BY THE NUMBERS: