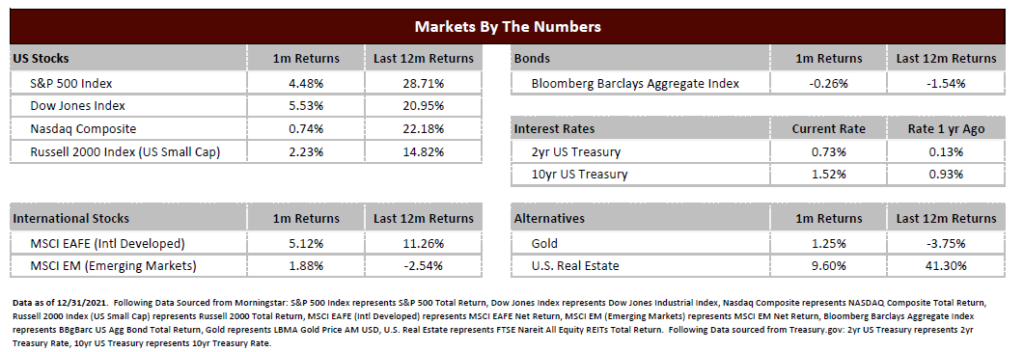

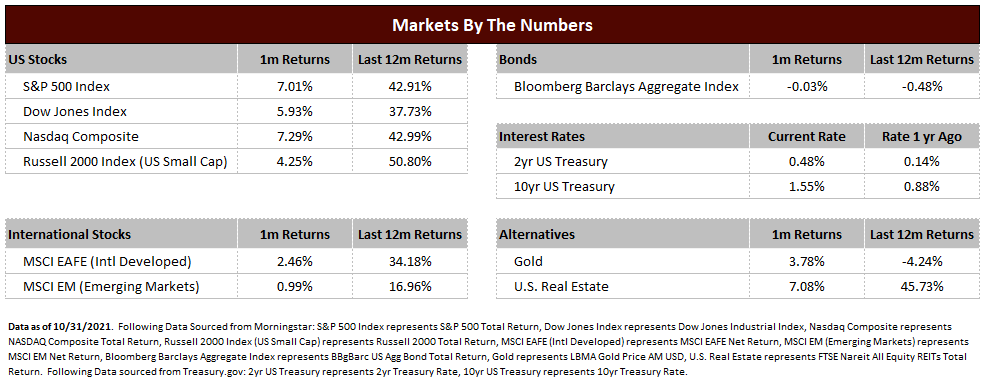

As we close out 2021, it was most definitely a year filled with ebbs, flows and great amounts of uncertainty. Looking back, it will be considered a very strong year for the stock markets while safer assets like bonds lagged. Given above average returns in both 2020 and 2021, it has been an impressive string of performance given the many challenges faced by consumers, businesse, and investors in both years.

While some would consider recent performance as “easy money conditions gone awry”, the markets haven’t been without risk. Events have happened at a frenetic pace, including:

- A global pandemic that has had significant ramifications for how we live, how we work, and even understanding what “normal life” now means.

- Cryptocurrency and meme stocks that were profitable for some left others with significant losses and volatility that makes the stock market seem tame.

- Lastly, the rise and fall of “pandemic” stocks, or companies that benefited from stay at home restrictions, is a case study in how speculation can have very different outcomes depending on your investment time frame. Companies such as Peloton (PTON), Teladoc (TDOC), and Citrix (CTXS) all faced meteoric rises as well as significant collapses in value over the past 20 months.

Regardless of the time frame, and in good times or bad, market uncertainty will always be a part of investing. There is always something on the horizon that could have a significant impact, good or bad, on market prices in the future. This has been true for decades, and a smart assumption is that this will be a part of investing in the decades to come.

However, as uncertainty is a part of past, present and future markets, investing with a plan has always been the antidote to this uncertainty. No one knows for certain what the future holds, but building a plan that considers risk and is flexible to changing markets and adaptable to life circumstances is the best way we can combat against the unknown. Understanding the difference between rampant speculation in the latest fad versus prudent long-term investing is critical to making money work for you to achieve your objectives.

As we think about what the market is going to look like in 2022, we rely on the same fundamentals that have defined market performance over the last 100 years.

- What is the state of the economy?

- What is the state of the companies within that economy?

- What is the valuation (or what we are currently paying) for those businesses?

We believe the economy is still on relatively solid footing but is not without challenges. Despite the many curveballs of the COVID pandemic, consumers are learning to live and adapt to ever-changing conditions and are financially healthy with jobs growing and wages rising. This usually portends to a strong US economy as much of our economic growth is derived from consumer spending.

The economic backdrop is positive for business revenue and earnings growth. Companies have bounced back from a difficult 2020 to grow earnings substantially in 2021, which we believe will continue (albeit at a slower pace) in 2022. Over the long term, markets tend to follow corporate earnings growth, and both are currently at all-time highs and earnings growth is expected to remain above 10% next year as well.

The final consideration, valuation, is at the high end of its historical range. We are paying more for companies than we did in prior years. However, interest rates remain relatively low and sentiment is that economic growth will continue to be robust, supporting a higher level of valuation. So, while markets are expensive and we wouldn’t expect significantly higher valuations from current levels, they are manageable if economic and company growth remains above average.

Because of these conditions, we believe that interest rates are more likely to rise than fall. This, combined with a very low starting point of income, keeps us cautious on bond returns. Bonds will provide some income as well as ballast to the volatility of the stock market, but we would expect very low to potentially negative returns in the bond market again in 2022.

For the stock market, we believe that markets can still go higher based on the reasons described above. Remember though, volatility should be expected and corrections of 5% or even 10% can happen once or many times in a given year. Given the strong performance of the past few years, it is wise to be prudent, but not overly cautious. We would expect a higher market, but likely not to the level of recent years.

Now, our perceived good conditions don’t come without potential threats. COVID, politics, inflation and the Federal Reserve can all play a role in market sentiment and could be a headwind to market performance if they deviate away from expectations. Further, there are sure to be other instances of uncertainty that are unknown to us now that may play an even bigger role in how the market perceives future risk.

However, all of these issues act as inputs into the long-term fundamental drivers of economic health, business growth and valuation. Understanding current events while keeping focused on the fundamentals is the cornerstone of how we manage your money. Using this in conjunction with your tailored investment plan to provide a customized solution that meets your objectives within the bounds of your risk tolerance will, as always, be the main goalposts on what we would consider a successful partnership.