September saw the first real signs of weakness in the stock markets this year. While the S&P 500 did not experience a 5% correction, many of the companies within the US market did experience corrections of 5% to 10% or more. During times of correction, investors often search for reasons as to why markets are selling off. While we never know with full accuracy why markets sell off (nor exactly when), the recent concerns include: a Chinese property company and contagion concerns, fears around the proliferation of COVID, inflation, a rapid increase in interest rates, an uncertain path regarding a US infrastructure bill package, and a potential government shutdown.

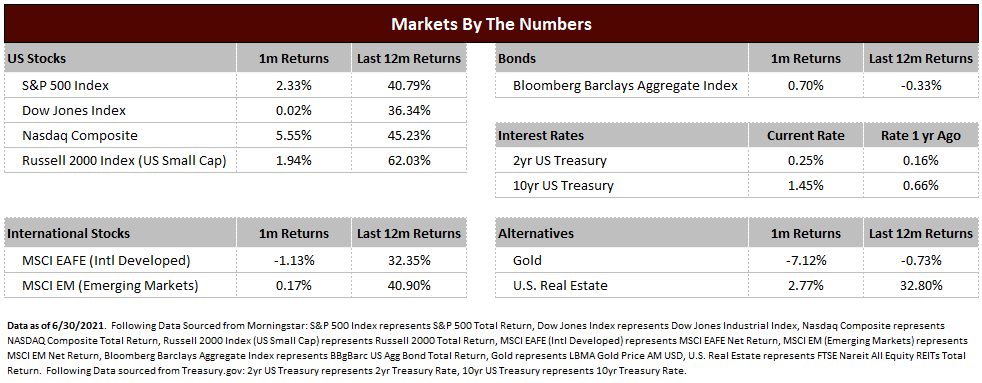

Stock markets across the globe declined in September. The S&P 500 broke a seven-month streak of gains after falling by 4.65% in the month. US small cap stocks fared slightly better than their large cap counterparts but were also down 2.95% in September. Lastly, international stocks declined during the month as fears around Chinese property development company Evergrande spurred a sell off in global stocks.

Bond performance also declined as long-term US interest rates rose during the month. The US Federal Reserve elected to keep the Fed Funds rate unchanged, but commentary regarding tapering (reducing their level of bond purchases) combined with economic inflation data sent long-term rates from 1.31% to 1.52% by month end. Despite the current rise in rates, real yields (treasury yields minus the inflation rate) remain near 20-year lows.

As we think about trends in the market, one thing remains consistent: investors always have something to fear. Political influences, contagion effects of a business gone awry, or simply that markets have worked “too well” are fears that will always be part of investing. Further, markets rarely move up in a straight line. The environment we experienced earlier in the year, with seven months of positive performance, is the exception rather than the rule. Market growth is rarely linear and trying to time the ebbs and flows perfectly usually leads to performance erosion rather than performance improvement.

At Gradient, we focus our decision making on longer term trends in economic and business fundamentals. We concentrate on trends in global economies, trends in the companies within those economies, and the valuation (what we pay) for those companies. Using this information as guideposts, over time, is what adds value to an investment process.

In that regard, the fundamentals keep us positive on the overall condition of our economy and the potential for continued stock performance. Both US and global economies are growing, and while inflation is a concern, we aren’t in red flag territory as of yet. The best measures of company performance are revenue and earnings growth. These metrics have been consistently exceeding expectations and S&P 500 earnings growth is expected to grow at an average of 25% this and next year. On the other side, valuations are not cheap. What we pay for stocks in the S&P 500 are at a premium to their long-term averages. While this is worth monitoring, we feel that higher valuations are justified based on continued low interest rates combined with an economy and businesses that should continue to grow at a higher than average rate.

These same fundamentals are what keep us cautious on the bond market. Historically, what investors receive for interest income at the beginning has been a good indicator of bond performance over the subsequent years. Currently, 10-year US Treasury rates are below the current inflation rate. Further, default spreads (the premium received for taking on default risk) are near record lows, which means both investment grade and high yield bonds are paying very low yield compared to long term history. While bonds can still have a place in client portfolios, the environment would suggest very low rates of return for bond allocations until rates rise to levels that make income more attractive.

Lastly, the investment philosophy of Gradient has always been to do the homework upfront. We understand the unique circumstances of each of our investors and build investment plans around personal investment objectives and tolerance for risk. Adherence to the plan, in both good times and bad, are the bedrock of growing assets over time but also protecting assets when markets suffer an inevitable, but temporary, decline. The world will always give us something to worry about, and those concerns are valid and worth monitoring. These concerns, however, often lead to greater value for investors who have a plan and can be opportunistic when others are fearful.

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222